- FLOKI Robinhood debut boosts retail interest, but bearish patterns and high on-chain flows hint at potential volatility.

- Traders should monitor key support levels to navigate possible short-term declines.

FLOKI surged in attention after its recent Robinhood listing, but technical signals suggest caution for traders eyeing short-term gains. Despite optimism from retail investors, bearish chart patterns and on-chain flows indicate potential volatility ahead.

Robinhood Listing Drives Buzz

Floki Inu (FLOKI) gained 6% on August 13, positioning it as the eighth-largest memecoin with a market capitalization of $1.12 billion. The listing on the U.S.-based trading platform opens FLOKI to more than 25 million users, a move the team hailed as a “huge step forward.”

The debut fueled retail participation, reflected in a 51% jump in 24-hour trading volume, according to CoinMarketCap. Yet, even with this uptick in activity, traders remain cautious amid mixed technical signals.

Bearish Chart Patterns Signal Risk

FLOKI’s recent price action highlights a potential inverted flag and pole pattern on the daily chart. On August 12, the memecoin dropped 9% to $0.00001069, failing to sustain the 50% Fibonacci retracement level and approaching the critical 61.8% level.

Analysts from AMBCrypto warn that a daily close below $0.00001055 could trigger an additional 10% decline toward $0.000009746, a key support level. The Supertrend indicator remains red, reinforcing the bearish bias, while the Relative Strength Index (RSI) hovers at 46, indicating neutral momentum.

On-Chain Activity Suggests Selling Pressure

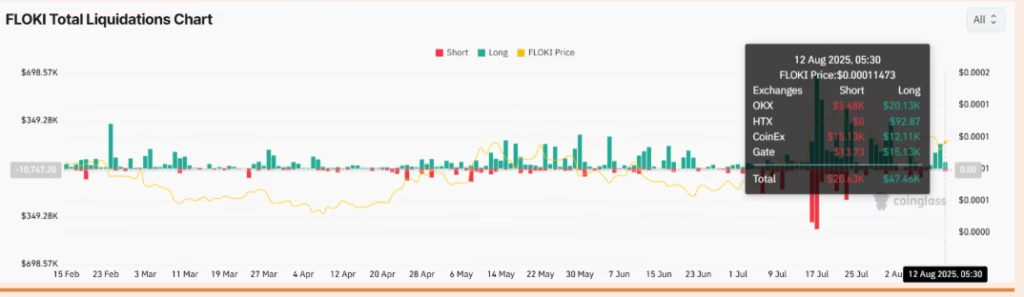

Data from CoinGlass reveals over $1.16 million worth of FLOKI tokens were moved to exchanges in the past 24 hours. This inflow hints at potential selling pressure, which could drive further price declines.

Liquidation activity also reflects heightened risk. At the time of writing, $68K in total FLOKI liquidations occurred, predominantly affecting long positions. Key liquidation clusters at $0.0001051 and $0.0001143 leave the memecoin vulnerable to sharp swings if these levels are breached.

What Traders Should Watch

While FLOKI’s Robinhood debut signals increased accessibility and retail interest, the current bearish patterns and on-chain flows suggest caution. Traders should monitor support levels and liquidation clusters closely to navigate potential volatility.

FLOKI remains a memecoin with long-term potential, but near-term price action is heavily influenced by technical factors and short-term trader sentiment.

ALSO READ:IOTA Wallets Surpass 600,000 as E-Sports Fan Tokens Drive Growth

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.