- Sui and Bittensor have surged up to 31% following the launch of Grayscale’s new investment trusts dedicated to these cryptocurrencies.

- The Grayscale Sui Trust and Grayscale Bittensor Trust offer investors simplified exposure to these tokens, contributing to their recent price gains.

Crypto Market Reacts to New Investment Opportunities

In a significant boost to the cryptocurrency market, Sui and Bittensor have experienced impressive price surges of up to 31% following the introduction of new investment trusts by Grayscale. These trusts are designed to simplify exposure to these digital assets, bypassing the traditional complexities of direct acquisition.

Sui’s Skyrocketing Performance

Sui, a lesser-known cryptocurrency, has taken center stage with a remarkable 31.84% increase in the past 24 hours. The token now trades at approximately $0.8315 (AU$1.25). This surge is attributed to the launch of the Grayscale Sui Trust, which provides a new way for investors to engage with Sui without the hassle of managing the token directly.

The trust aims to offer a more accessible investment route into Sui, capturing significant interest and driving its price up.

Bittensor’s Notable Climb

Bittensor (TAO) is also in the spotlight, seeing a notable 15% rise from $267.23 (AU$405.53) to $304.27 (AU$461.74). The Grayscale Bittensor Trust has played a crucial role in this rally, offering accredited investors an opportunity to gain exposure to Bittensor Protocol through a managed fund.

This new trust is part of Grayscale’s ongoing expansion of its cryptocurrency investment products, which include funds for various digital assets.

Grayscale’s Strategic Moves

Grayscale’s recent additions, the Grayscale Bittensor Trust and the Grayscale Sui Trust, highlight the firm’s strategy to cater to diverse investor interests in the cryptocurrency space. These new trusts join a growing list of Grayscale products, which already include funds for Basic Attention Token (BAT), Chainlink (LINK), and Solana (SOL), among others.

Broader Market Trends

The rally in Sui and Bittensor follows a broader recovery in the crypto market after a significant market crash on Monday. Alongside Sui and Bittensor, other cryptocurrencies like Helium, Sei, and Celestia have also shown strong performance. This uptick comes amid ongoing adjustments in Grayscale’s portfolio, including recent removals and additions to their Digital Large Cap Fund (GDLC) and Smart Contract Platform Ex-Ethereum Fund (GSCPxE).

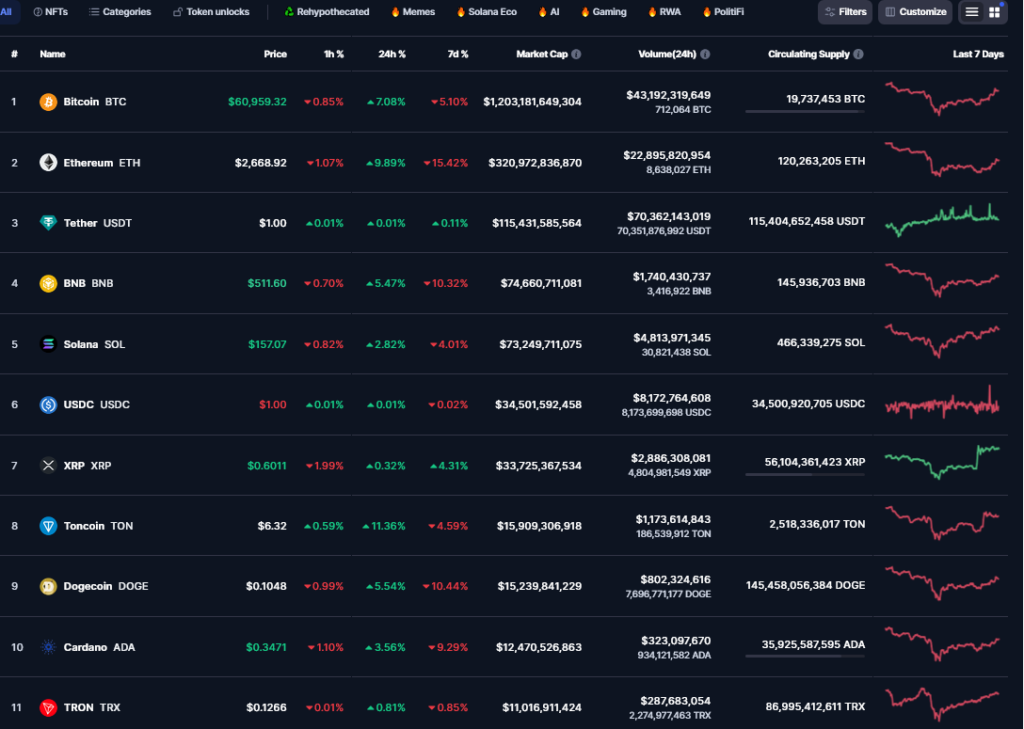

Amid these developments, Cardano (ADA) has faced some challenges. Grayscale’s decision to remove ADA from its GDLC fund earlier this year has been met with criticism from Cardano’s founder, Charles Hoskinson. Despite these setbacks, ADA remains a significant player in the market, currently holding the tenth spot by market cap.

As the cryptocurrency landscape continues to evolve, Grayscale’s new trusts represent a strategic move to capture the growing interest in emerging digital assets, offering investors more ways to engage with this dynamic market.