- HBAR surged 27% to reach a four-month high, surpassing Bitcoin Cash with a market cap of $10.74 billion.

- Despite nearing overbought levels, its strong correlation with Bitcoin may help sustain further gains.

HBAR has recently captured the spotlight in the crypto market by surging 27% in just 24 hours, reaching its highest price in four months. This strong rally has propelled HBAR’s market capitalization to $10.74 billion, allowing it to overtake Bitcoin Cash and grab the attention of investors and traders alike.

Sharp Inflows Signal Potential Overbought Conditions

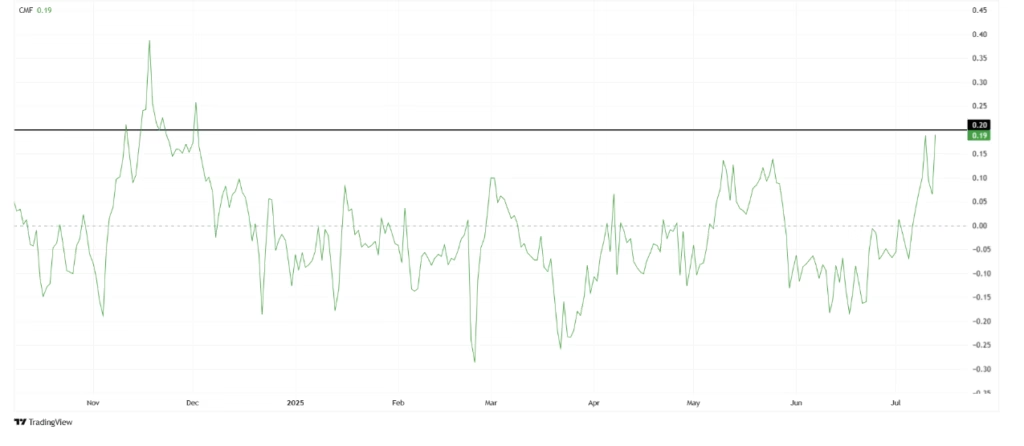

The Chaikin Money Flow (CMF) indicator, which measures buying and selling pressure, shows significant inflows into HBAR. Currently approaching the 0.20 threshold, the CMF warns that the altcoin might be entering overbought territory. When an asset becomes overbought, it often signals that a price pullback or correction could be imminent as investors look to take profits.

While the current sentiment is highly bullish, investor caution is warranted. Should the CMF cross above 0.20, it may confirm the overextended rally, leading to short-term price declines as selling pressure increases.

Strong Correlation with Bitcoin Offers Support

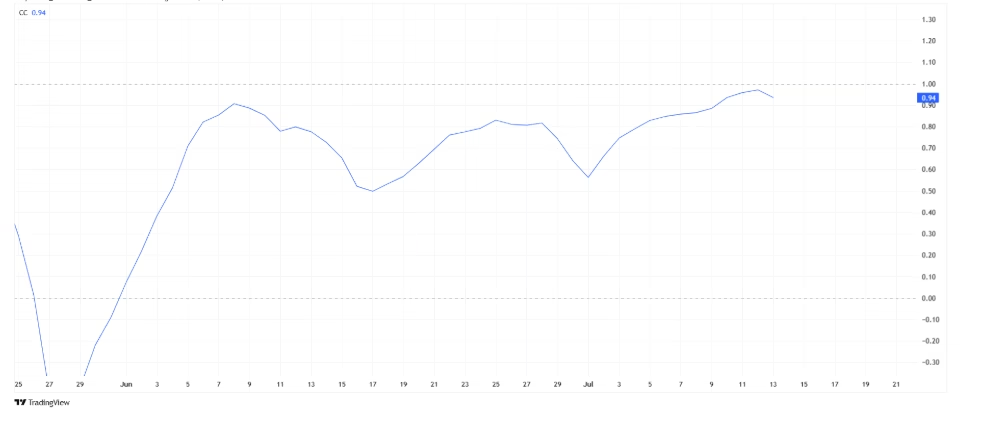

One key factor that could help HBAR sustain its momentum is its strong correlation with Bitcoin, currently at 0.94. Bitcoin itself is nearing a new all-time high around $120,000. Historically, when Bitcoin strengthens, it tends to lift other cryptocurrencies due to shared market sentiment and investor interest.

This close relationship suggests that despite the overbought signals, HBAR could avoid a sharp correction if Bitcoin continues its upward trajectory. Bitcoin’s rally may provide the necessary support to keep HBAR’s price on an upward path, attracting further investment.

What’s Next for HBAR?

At the time of writing, HBAR is trading at the key resistance level of $0.250. Holding this level as support is critical for HBAR to maintain its bullish trend and target a potential rise to $0.267. The continued strength of Bitcoin will likely play a crucial role in pushing HBAR beyond this resistance.

However, if HBAR fails to sustain above $0.250 or encounters significant selling pressure, it could slip back to $0.220 or even $0.188, signaling a possible reversal in its recent surge.

In summary, HBAR’s impressive 27% jump and market cap growth have put it ahead of Bitcoin Cash, but cautious investors should watch closely for overbought signals and Bitcoin’s price movements. If the altcoin can hold above key levels, the rally may have more room to run.