- Trump’s tariffs, set to be unveiled on April 2, 2025, have put short-term pressure on Bitcoin, but experts believe the weakening dollar could drive BTC’s long-term value to $150,000.

- Liquidity withdrawals from major investors could also fuel a price surge, though stability remains uncertain.

As the Trump administration prepares to unveil its tariff strategy on April 2, 2025, financial markets are on edge. The new tariffs, which target 15 countries, including China, Canada, and Mexico, are expected to disrupt global trade and impact various asset classes, including cryptocurrencies like Bitcoin (BTC).

Short-Term Pressure on Bitcoin

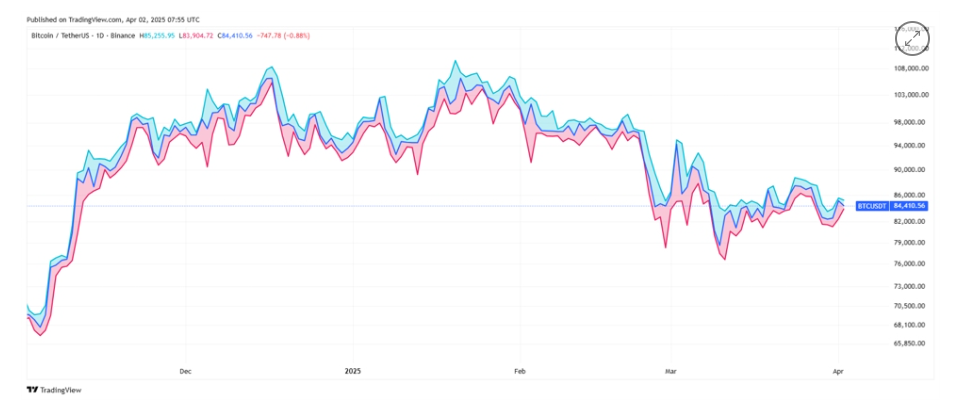

In anticipation of the tariffs, Bitcoin has been trading within a bearish channel, struggling to break resistance levels at $87,000 and $92,000.

The cryptocurrency’s price has already dropped from nearly $110,000 earlier this year to $84,327. The introduction of tariffs has heightened economic uncertainty, leading investors to seek safe-haven assets like gold, which has surged by 18% year-to-date.

A Silver Lining for Bitcoin’s Long-Term Outlook

Despite the short-term pressure, some experts believe that Trump’s tariffs could ultimately benefit Bitcoin. As the U.S. dollar weakens due to strained international trade relationships, Bitcoin’s appeal as a decentralized, non-sovereign asset may strengthen. Zach Pandl, Head of Research at Grayscale, argues that the tariffs could weaken the dollar’s dominance, creating an opportunity for Bitcoin to emerge as a global monetary asset.

Potential for a $150,000 Bitcoin?

According to blockchain researcher Dr. Kirill Kretov, recent liquidity withdrawals from active Bitcoin addresses suggest a bullish outlook. Large-scale withdrawals, particularly from institutional and high-net-worth investors, could lead to a supply crunch, driving prices higher. Kretov notes that in a low-liquidity environment, even moderate buy orders could significantly impact Bitcoin’s price, possibly pushing it to $150,000. However, he cautions against relying on low-liquidity conditions for sustainable growth.

The impact of Trump’s tariffs on Bitcoin remains uncertain, with short-term volatility expected. However, the possibility of Bitcoin becoming a hedge against a fragmented global financial system remains a promising scenario. As the tariffs take effect, investors and analysts will be watching closely for signs of a breakout from Bitcoin’s bearish channel. Could Bitcoin’s next move be a rally to $150,000? Only time will tell.