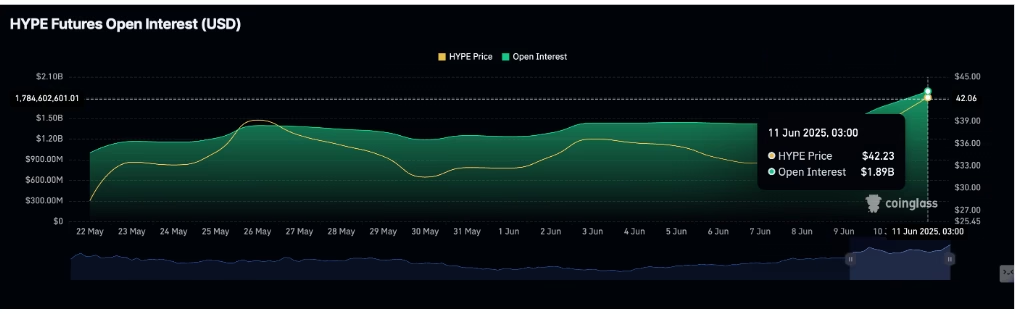

- Hyperliquid (HYPE) surged nearly 400% to an all-time high of $43.00, supported by a 34% rise in futures open interest to $1.89 billion.

- Despite a slight pullback, bullish indicators like MACD and MFI suggest strong investor interest and potential for further gains if $43 resistance is broken.

Hyperliquid (HYPE), the high-performance Layer-1 blockchain optimized for user-built applications, has stormed into the spotlight once again. After plunging to $9.37 in early April, HYPE has skyrocketed nearly 400%, peaking at a new all-time high of $43.00 before pulling back slightly to $41.33.

Bullish Signs as Hyperliquid Open Interest Hits Record High

June has been particularly bullish for Hyperliquid, with futures Open Interest (OI) surging 34% to reach a new peak of $1.89 billion. This dramatic rise suggests a strengthening belief among investors that HYPE’s price discovery phase isn’t over. Paired with a trading volume of $2.16 billion, the elevated OI points to increased market participation and growing speculative activity.

A long-to-short ratio of 1.0367 further reinforces the optimistic sentiment, showing that traders are slightly more inclined to go long than short on HYPE.

Indicators Support a Bullish Structure

Despite the mild correction from its peak, HYPE remains structurally strong. The Moving Average Convergence Divergence (MACD) indicator recently flashed a buy signal—often a green light for bullish traders—when the MACD line crossed above the signal line. This crossover, along with positive histogram bars, shows that bulls are still in control.

Another bullish indicator, the Money Flow Index (MFI), has climbed back above the 50 midline, suggesting that capital continues to flow into the token. HYPE’s current price is well above key support levels like the 50-day EMA at $29.56 and the 100-day EMA at $25.67, which adds further weight to the bullish case.

Key Levels to Watch

For now, HYPE is holding firm above short-term support at $40.00. If bulls can reclaim control and push the price past the $43.00 resistance level, new highs could follow. However, failure to break above this ceiling could invite sellers back in, potentially dragging the token down to support levels at $36 or even $32.

As market sentiment remains cautious following unresolved trade dynamics between the US and China, HYPE’s path forward will largely depend on whether traders continue to back its breakout—or start to lock in profits.