- Hyperliquid overtook Solana in July 2025 by capturing 35% of blockchain revenue, driven by its simpler and more functional derivatives trading platform.

- Meanwhile, Solana struggles with technical setbacks and declining user engagement, while Ethereum gains traction with strong price growth and Layer 2 adoption.

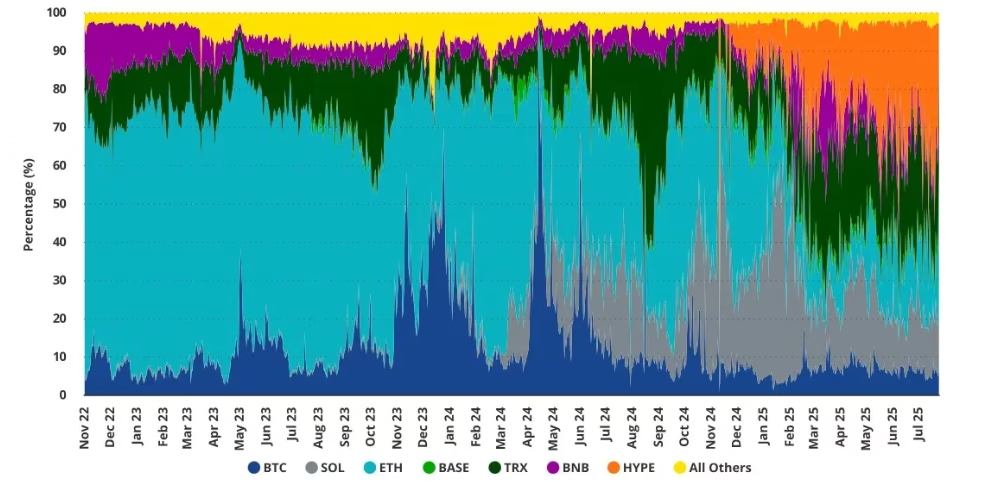

In a surprising turn of events, Hyperliquid, a decentralized derivatives exchange, claimed 35% of all blockchain revenue in July 2025, overtaking well-established platforms including Solana, Ethereum, and BNB Chain. This milestone was highlighted in the latest VanEck crypto report, signaling a major shift in the on-chain trading landscape. Hyperliquid’s rise appears to have come largely at Solana’s expense, which once dominated the blockchain transaction fee revenue charts.

Solana’s Rise and Decline

At the start of 2025, Solana (SOL) surged past $260, fueled partly by the meme coin craze. At its peak, Solana generated more transaction fees than the next four chains combined, showcasing its dominance in the space. However, since then, Solana’s price has retreated, hovering around $165 and posting a 13% decline year-to-date. Solana’s decentralized exchange TVL (Total Value Locked) dipped slightly in recent weeks, though it remains up 11% over the month.

Why Hyperliquid is Winning Users

Hyperliquid has effectively attracted and retained Solana’s most valuable users by offering a simpler, more functional product—especially in the perpetual futures trading market. The platform’s native token, HYPE, has climbed into the top 15 cryptocurrencies, boasting a market cap exceeding $12.5 billion and a 57% gain year-to-date. Although HYPE’s price dropped by 12% over the past week, it remains well ahead of many major cryptos, including Bitcoin and Ethereum.

Solana’s Challenges and Ethereum’s Comeback

Solana’s technical edge and builder ecosystem were once seen as its greatest strengths. However, delays and internal conflicts around the Firedancer upgrade project—intended to boost performance and reliability—have hurt the chain’s momentum. The project’s missed deadlines and talent losses have raised questions about Solana’s future trajectory. Meanwhile, Ethereum appears to be regaining its crown, with a recent 41% price surge aided by growing adoption of Layer 2 solutions for institutional use.

What Lies Ahead for Solana?

Solana’s ability to remain relevant depends heavily on turning its throughput capacity into meaningful economic activity. But persistent concerns about reliability continue to deter many institutional developers. The next few months will be critical as Solana works to prove it can regain its footing in a rapidly evolving blockchain ecosystem.

This snapshot of blockchain revenue leaders shows that innovation and user experience remain key to winning the market — and Hyperliquid’s breakout success proves just that.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.