- Litecoin surged over 20% this week, breaking key resistance with strong bullish signals and reduced sell pressure from exchange outflows.

- However, high leverage poses downside risk if prices dip, while a push past $120 could fuel a move toward $147.

Litecoin (LTC) has made a surprise comeback, soaring over 20% in just a week and grabbing the market’s attention once again. After trading under $100 for a stretch, the cryptocurrency blasted through resistance levels and now hovers around $116. With bullish signs mounting and analysts eyeing $147 as a potential upside target, investors are asking: is this just the beginning of a bigger run?

Bullish Signals Strengthen as BBP Hits 22.5

One of the clearest signs that bulls are in control is the Bull-Bear Power (BBP) indicator. This metric turned green earlier in the month and has continued to climb, recently crossing 22.5—a key level that signals buyers are firmly in charge. When BBP rises in tandem with price, it’s a strong confirmation that the rally has depth.

High Leverage Could Be a Double-Edged Sword

Despite the bullish setup, the market remains heavily leveraged. Over $33 million in long positions sit just below current price levels, making the rally fragile. If LTC drops even slightly, these leveraged bets could trigger a cascade of liquidations. On the flip side, $19 million in short positions above the current range could add rocket fuel if prices push past $120 and beyond.

Exchange Outflows Point to Strong Holder Confidence

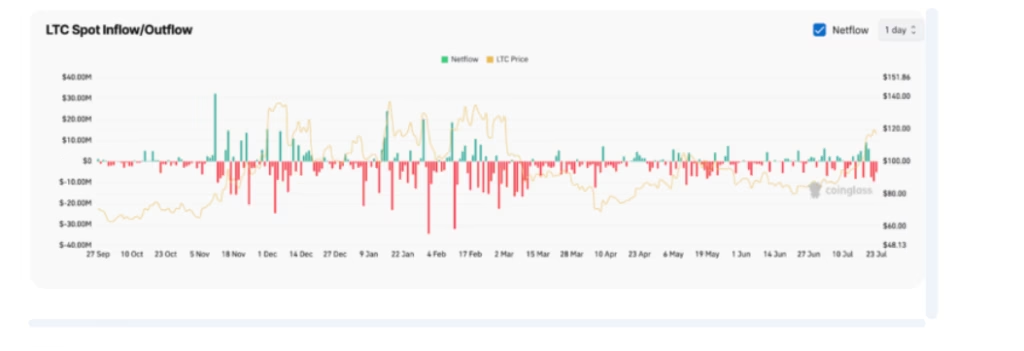

Another positive signal is the $5.12 million in LTC outflows from exchanges in recent sessions. When coins leave trading platforms, it often means holders are moving them to cold storage or decentralized applications—reducing immediate sell pressure. Fewer coins on exchanges typically leads to a supply squeeze, which can help lift prices even further.

$147 in Sight—But What Could Derail the Rally?

LTC has already cleared resistance at $103 and $110, and is now testing the $120 zone. If it can push through, Fibonacci extension analysis suggests $130, $139, and ultimately $147.56 could be within reach—a 27% increase from current levels.

Still, if Litecoin slips back under $110 or worse, falls below $104, the bullish narrative could quickly unravel. That would put the asset back into correction territory and cool off the current excitement.

Litecoin’s rally is backed by solid technical indicators, growing buyer strength, and reduced sell pressure. While leverage adds some risk, the path to $147 remains open—if the bulls can maintain their grip.