- Sui (SUI) is facing resistance and may risk a pullback to $1.70 if its breakout attempt fails, as momentum indicators show weakening strength.

- In contrast, Toncoin (TON) is gaining after correcting previous imbalances, with bullish signals pointing to a potential rise toward the $4 level.

In today’s crypto spotlight, two major altcoins — Sui (SUI) and Toncoin (TON) — are displaying very different market dynamics despite having nearly identical market capitalizations of over $7 billion. While SUI battles a key resistance zone, TON is showing signs of recovery after a correction-filled stretch.

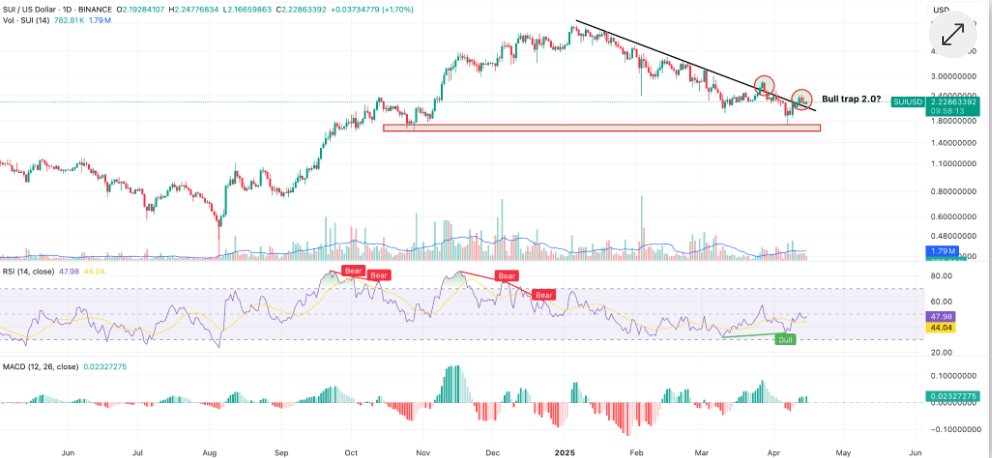

SUI at a Crossroads: Bull Trap or Breakout?

Sui is once again attempting to push past its stubborn trend line resistance after bouncing off its $1.70 support level. The last time it broke this barrier in March, the move proved to be a bull trap, followed by a sharp 32% decline. With the current setup echoing that pattern, caution is warranted.

Momentum indicators suggest that bullish strength may already be fading. The MACD histogram has turned light red for the second day in a row, hinting at weakening upward momentum. Simultaneously, the RSI is hovering near the signal line, and early trading in the American session has introduced selling pressure.

If this breakout fails like the last one, SUI could retrace toward the $1.70 support — a potential 25% downside from current levels.

TON Finds Its Footing as Technicals Align

While SUI teeters on the edge, Toncoin (TON) is pushing upward with renewed energy. After a steep sell-off in April, TON filled the supply imbalance created during its mid-March rally. That rally had followed a spike in optimism around Telegram’s founder, Pavel Durov, returning home after legal troubles in France were resolved.

Now that the imbalance is resolved, TON has booked a 7% gain in the last 24 hours, and technical indicators support further upside. The MACD’s negative momentum is waning, and the RSI is climbing, testing the signal line from below — a bullish sign.

If TON continues to build on this momentum, the price could rise toward the $4 resistance level in the coming weeks. However, traders should also watch for a potential pullback to the $2.76 support zone.

Calm Volumes Amid Market Stabilization

Interestingly, both SUI and TON are experiencing lower trading volumes, indicating that recent price moves are not necessarily being driven by strong investor conviction. As volatility cools across the broader market, this could either serve as a consolidation phase or signal a lack of interest.

For now, traders and investors alike will be watching closely to see whether SUI’s breakout attempt holds — or fails once again — and whether TON can turn its technical strength into sustained gains.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.