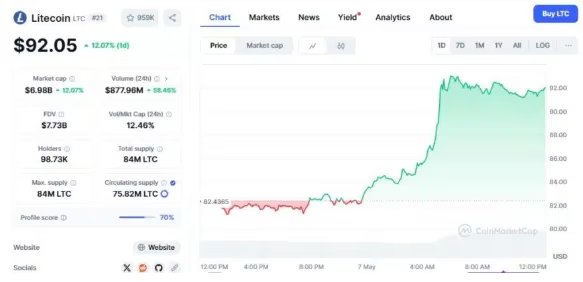

- Litecoin surged 12% to $92.05 after the SEC delayed its decision on a proposed spot ETF, sparking increased investor interest.

- Despite the regulatory pause, trading volume soared 59%, signaling strong market optimism about future ETF approval.

Litecoin (LTC) defied expectations on Tuesday, posting a sharp 12% price rally despite—or perhaps because of—a regulatory delay. The U.S. Securities and Exchange Commission (SEC) postponed its decision on a proposed spot Litecoin exchange-traded fund (ETF), but the market reaction was overwhelmingly bullish.

Litecoin Investors React Positively to Uncertainty

While regulatory delays usually bring hesitation, this time investors seemed to view the SEC’s move as a step closer to eventual approval. LTC surged to around $92.05 within 24 hours, with trading volume skyrocketing more than 59% to hit $877 million.

The ETF proposal, put forth by Canary Funds, aims to launch the first U.S.-based spot ETF tied directly to Litecoin’s price. Rather than issuing a final verdict, the SEC invited public comments on whether the product could adequately guard against fraud and manipulation—two sticking points in previous ETF deliberations.

ALSO READ:XRP Holds $2.10 Support with Bullish Hopes Ahead of Trade Talks

A Vote of Confidence in Crypto ETFs

The market’s reaction suggests continued optimism around crypto ETFs, even as regulators remain cautious. Investors appear willing to bet that a spot Litecoin ETF could eventually see approval, possibly in 2025, when the current comment and review cycle might wrap up.

Litecoin’s market capitalization now stands close to $7 billion, placing it at #21 in the global crypto rankings. The strong surge shows that despite the SEC’s indecision, investor sentiment is far from uncertain.

The SEC’s decision to delay isn’t a definitive setback. Instead, it has sparked renewed interest in Litecoin, reinforcing the belief that traditional financial products like ETFs are becoming increasingly intertwined with the crypto space.

For now, LTC holders will be watching closely as public comments roll in. Whether the ETF gets approved next year or not, the recent rally confirms one thing: appetite for regulated crypto investment vehicles remains strong.

MIGHT ALSO LIKE :Why Ripple is Eyeing USDC Issuer Circle: What’s at Stake for XRP

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.