Austin, Texas, August 7th, 2025, Chainwire

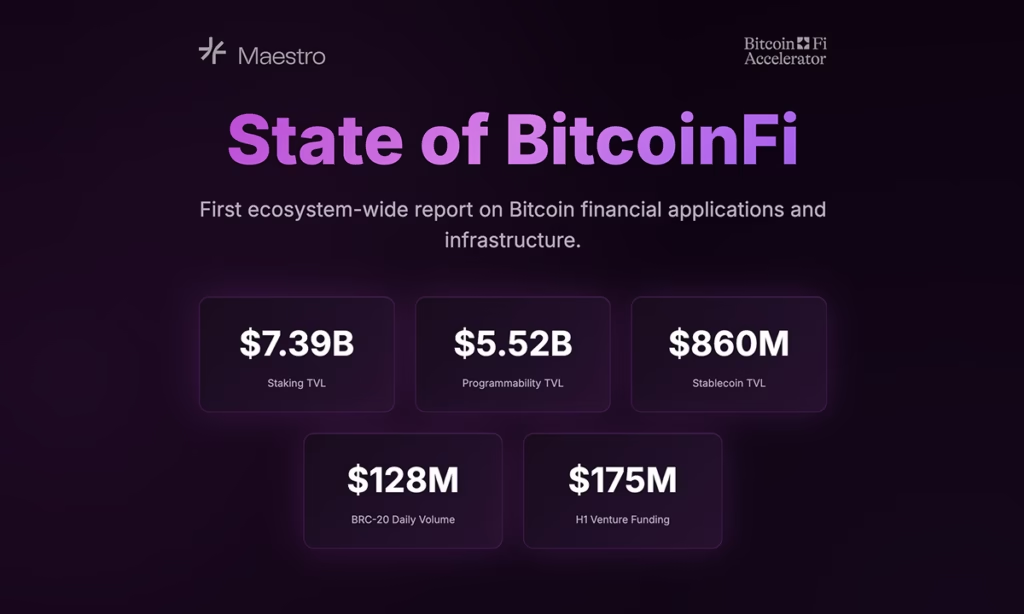

Maestro, the leading BitcoinFi infrastructure provider, has released the “State of BitcoinFi,” the industry’s most comprehensive ecosystem-wide report on Bitcoin financial applications, infrastructure, and the ongoing expansion of Bitcoin’s utility from storing value to powering global finance’s transition to on-chain rails.

The State of BitcoinFi research report presents data-driven protocol performance, market analysis, institutional outlooks, and the state of venture funding into the BitcoinFi ecosystem. It reveals that staking and lending have emerged as the primary areas where BitcoinFi is achieving product-market fit. Maestro expects BitcoinFi volumes to surge as a growing number of institutions add Bitcoin to their balance sheets and custodians activate idle BTC searching for yield and utility.

“We’re witnessing the convergence of TradFi and DeFi into a Bitcoin‑denominated capital market,” said Marvin Bertin, Co‑Founder and CEO of Maestro. “For the first time since 2009, the critical pieces for on‑chain financial apps on Bitcoin are in place, spanning exchanges, lending, and stablecoins. Bitcoin is evolving from a static reserve asset into a dynamic, productive financial network.”

Key insights:

- Staking and lending: With over ₿68.5K of TVL ($7.39 billion), staking has become the most widely adopted application in BitcoinFi. An additional $3.32 billion worth of BTC is locked in restaking, meaning BitcoinFi now secures over $10 billion in value through yield-generating protocols. While Babylon ($4.79B) leads in scale, Solv, Lombard, and CoreDAO are pushing the frontier with liquid staking tokens (LSTs), restaking strategies, and dual-token security models. Liquidium has become an early leader in Bitcoin-native lending with over $500M in volume.

- Programmability layers: Bitcoin L2s and scaling layers have $5.52B (52k BTC) in TVL, signalling real developer and user demand driven by BTC-native smart contracts, yield, and asset issuance while preserving self-custody and Bitcoin settlement guarantees. Stacks led all layers in growth, adding ~2,000 BTC and more than doubling its TVL in Q2. Sidechains still hold the most BTC in BitcoinFi, but the architecture is rapidly diversifying, with rollups and execution layers looking promising.

- Metaprotocols: Runes, Ordinals, and BRC-20s accounted for 40.6% of all Bitcoin transactions in H1 2025. The BRC-20 daily volume has surged to $128 million. Ordinals, after a pullback in 2024, witnessed a strong recovery with over 80 million inscriptions created by mid-2025, generating 6,940 BTC (approximately $681M) in fees. The Runes minting and trading volume declined sharply by year-end 2024, though the activity rebounded in March and April 2025.

- Stablecoins: With $860M in TVL (+42.3% QoQ), stablecoins have begun to take hold in the Bitcoin ecosystem, thanks to the maturation of Bitcoin L2s and growing demand for native financial primitives. CDP-based (Collateralized Debt Position) stablecoins like Avalon’s USDa ($559M) have found early traction in BitcoinFi. The introduction of high-yield stablecoins, such as Hermetica’s 25% APY offering, underscores the demand for income-generating assets within BitcoinFi.

- Venture funding: After a period of declining investments, BitcoinFi venture funding surged to $175 million across 32 rounds in the first half of 2025. The funding activities are no longer narrowly focused on infrastructure. In H1 2025, 20 out of 32 deals focused on DeFi, custody, or consumer apps. Capital is pivoting toward usability and demand-driven products, while infrastructure bets mature in the background.

The BitcoinFi infrastructure tooling has matured quickly across indexers, wallets, explorers, and marketplaces, enabling a strong layer for building consumer and institutional applications. Maestro itself is leading the charge with its BitcoinFi infrastructure platform powering more than 250 applications.

Maestro prepared the report in collaboration with BitcoinFi Accelerator. The full report is available here.

About Maestro

Maestro is the first enterprise-grade BitcoinFi infrastructure provider. Its mission is to accelerate the world’s transition to the Bitcoin Economy by delivering a comprehensive, scalable infrastructure stack optimized for on-chain finance. By empowering developers and businesses with robust software tooling, Maestro is setting a new standard for how financial applications are built on Bitcoin, fueling the evolution of a decentralized, blockchain-native financial system.

Learn more: https://www.gomaestro.org/

Contact

Davis Richardson

drichardson@gomaestro.org