- MANTRA’s OM token crashed 90% in a single day, wiping out an estimated $5 billion in market value, amid allegations of insider sell-offs and market manipulation.

- The project’s team denies any wrongdoing, attributing the collapse to external “reckless liquidations,” while investors demand legal action and accountability.

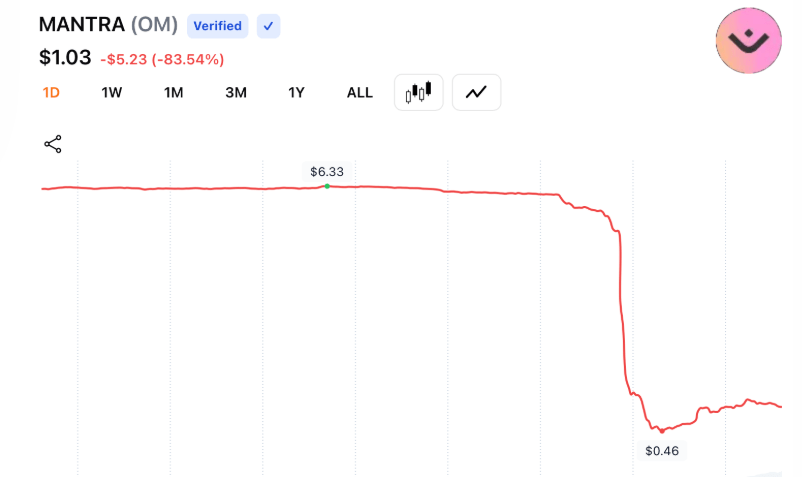

The MANTRA crypto project is facing intense scrutiny after its OM token saw a drastic 90% crash on Sunday, triggering allegations of insider manipulation. The sharp drop has left investors reeling, with the market value of OM token wiping out an estimated $5 billion in just one day.

A Historic Drop and Growing Controversy

MANTRA, a platform known for its focus on tokenizing real-world assets (RWAs), has long been regarded as a promising player in the blockchain space. With high-profile partnerships with Google Cloud and Dubai’s DAMAC Group, the project had garnered significant attention. However, the sudden collapse of the OM token from over $6 to $0.37 within 24 hours has sparked widespread outrage.

At its peak earlier in 2025, the OM token was valued at $9. Now, it hovers around $1.03, as of 7:40 p.m. EDT. Social media erupted with claims that insiders, or even market makers, were behind the dramatic sell-off. The allegations suggest that a large portion of circulating OM tokens was offloaded over-the-counter (OTC), and the project’s Telegram group was deleted, severing communication with the community.

MANTRA’s Denial and Public Backlash

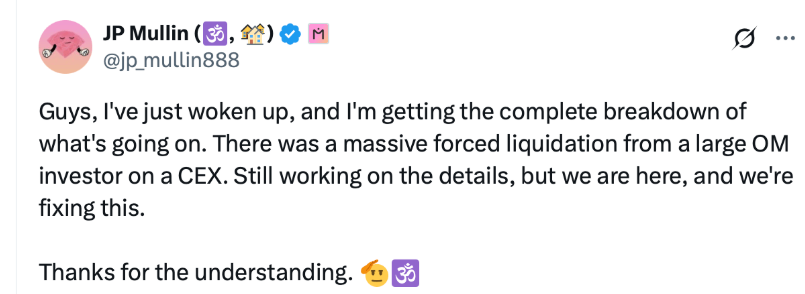

In response, MANTRA took to its social media channels to deny any involvement, attributing the collapse to “reckless liquidations” by external actors. The team reassured the community, stating, “We want to assure you that MANTRA is fundamentally strong. Today’s activity was triggered by reckless liquidations, not anything to do with the project.” Despite these reassurances, critics remain unconvinced.

Onchain investigator ZachXBT questioned the credibility of MANTRA’s response, pointing out the scale of the drop from $5.9 billion to $500 million in market cap in a single candle. The lack of clear answers only fueled further suspicions.

A Battle for Trust

John Patrick Mullin, MANTRA’s co-founder, denied the insider sell-off allegations, explaining that a large OM investor was forced to liquidate their holdings. However, the damage had already been done, and some investors are now calling for legal action, labeling the event as a “scam.”

As investigations into the incident continue, the crash serves as a stark reminder of the volatility and risks inherent in decentralized finance (DeFi) projects, particularly those attempting to bridge traditional financial systems with blockchain technology. MANTRA’s handling of the situation could have long-term consequences, not just for the platform, but for the future of tokenization ecosystems as a whole.

The Road Ahead

While MANTRA’s team continues to investigate, the lack of transparency and swift action has left many investors questioning the project’s credibility. As the legal ramifications unfold, the broader crypto community will be watching closely, as this incident may set a precedent for how DeFi platforms handle such crises moving forward.