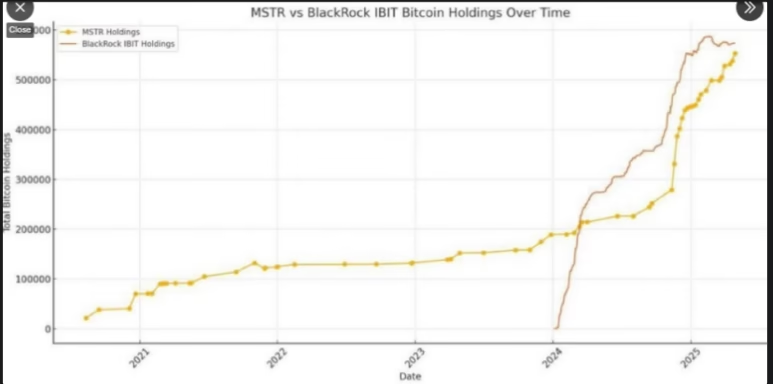

- MicroStrategy and BlackRock are competing to be the first to hold 1 million Bitcoin, each surpassing 500,000 BTC.

- While MicroStrategy’s strategy is driven by CEO Michael Saylor’s conviction, BlackRock’s momentum comes from its successful Bitcoin ETF and institutional backing.

The race to amass 1 million Bitcoin is on, with two heavyweights—MicroStrategy and BlackRock—leading the charge. Both companies have made significant strides toward this milestone, but the question remains: who will reach it first?

MicroStrategy’s Bitcoin Conviction

MicroStrategy, led by Bitcoin maximalist Michael Saylor, has been aggressively accumulating Bitcoin since 2020. With over 550,000 BTC in its possession, the software company continues to purchase Bitcoin at a steady pace. MicroStrategy’s most recent acquisition of 15,355 BTC for $1.42 billion is a testament to its unwavering belief in Bitcoin’s long-term value.

Saylor’s leadership and deep conviction in Bitcoin are critical factors in the company’s push toward 1 million BTC. MicroStrategy has become a Bitcoin-first company, using innovative methods such as stock offerings and convertible notes to fund its purchases. The firm’s strategy is bold, with no sign of slowing down, even amid market fluctuations.

BlackRock’s Rapid Accumulation

On the other hand, BlackRock, through its iShares Bitcoin Trust (IBIT), is not far behind. Holding over 573,000 BTC, BlackRock has gained significant ground since launching its Bitcoin ETF. The rapid growth of the IBIT, bolstered by over $1 billion in inflows in a single day, puts BlackRock in a strong position to challenge MicroStrategy.

BlackRock benefits from clear regulatory frameworks around its ETF, which drives institutional investor confidence and bolsters demand. However, its strategy is closely tied to investor sentiment—should there be any significant outflows, the pace of accumulation could slow considerably.

A Race to the Finish Line

Both companies are well over the halfway mark, but the race is too close to call. MicroStrategy’s commitment to Bitcoin is driven by Saylor’s personal belief in the cryptocurrency, while BlackRock’s momentum stems from the ETF’s success and institutional interest. Each firm has its own advantages, with MicroStrategy’s steady accumulation strategy countered by BlackRock’s impressive ETF growth.

In the end, while MicroStrategy’s unyielding commitment and aggressive tactics may give it an edge, BlackRock’s rapid accumulation and institutional backing could propel it to the 1 million BTC milestone first. Time will tell which of these giants will win the race to 1 million Bitcoin.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.