- MYX Finance surged 1,400% in a week due to Trump-linked listings and high derivatives activity.

- Analysts warn a sharp 70–85% correction may occur as technical signals point to overbought conditions.

MYX Finance (MYX) has captured the crypto world’s attention after an astonishing 1,400% surge in just seven days, reaching an all-time high of $18.42. While traders celebrated the meteoric rise, analysts are warning of significant downside risks, with potential corrections ranging between 70–85% in the coming weeks.

What is MYX Finance?

MYX Finance is a decentralized perpetual exchange that uses a novel Matching Pool Mechanism (MPM). Unlike traditional order books or automated market makers (AMMs), the MPM first takes the opposite side of trades before pairing longs and shorts later. This system aims to minimize slippage and deliver a trading experience similar to centralized exchanges while remaining fully on-chain.

The platform supports USDC-margined contracts with up to 50x leverage and utilizes a dual-oracle system for pricing, attracting traders seeking high-risk, high-reward opportunities.

Catalysts Behind the MYX Price Surge

Several key events contributed to MYX’s recent rally. On September 5, MYX Finance announced the listing of the World Liberty Financial (WLFI) token, linked to former U.S. President Donald Trump and his family. The announcement immediately fueled speculation, drawing attention from retail traders and boosting MYX’s visibility.

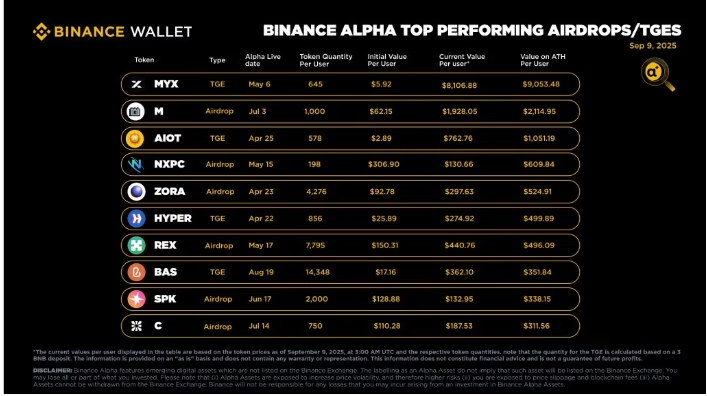

The rally was further amplified by Binance Alpha, where MYX ranked among the best-performing airdrops and token generation events (TGEs). Early investors saw token allocations jump from roughly $5.92 to over $8,100 per user, highlighting the explosive returns that attracted additional buyers.

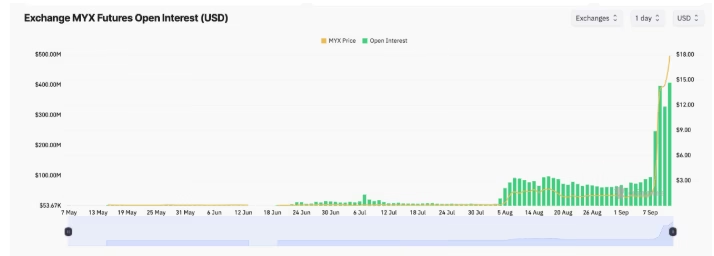

High derivatives activity also played a role. Open interest exceeded $400 million

and persistent short liquidations between September 6 and 10—totaling $89.51 million—pushed prices higher. With limited circulating supply and high-leverage trading, these forced buybacks accelerated the parabolic move toward $18.

Red Flags and Warning Signs

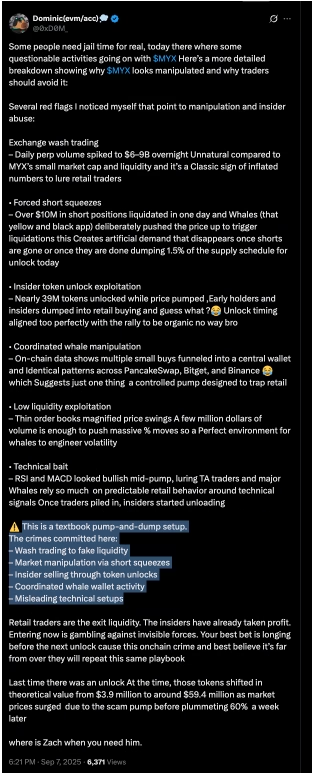

Despite the rally, analysts caution that the surge may be unsustainable. A 39 million token unlock coincided with the price spike, raising concerns about early holders exiting at inflated levels. Observers have noted unusual trading patterns, including massive daily perpetual volumes of $6–9 billion and potential whale coordination across major exchanges.

Technical indicators also suggest overextension. MYX’s relative strength index (RSI) reached 89–97, signaling extreme overbought conditions. Past patterns indicate a similar scenario in August led to a 60% price crash. If history repeats, MYX could correct toward $2.72–$5.10 in the coming weeks.

In summary, while MYX Finance has delivered breathtaking short-term gains, the market faces significant downside risks. Traders should approach with caution and consider the high potential for a sharp pullback.

ALSO READ:IOTA Security Strengthens with Keystone Wallet Firmware Update and Rumored Custom Edition

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.