- OKB surged 400% to $250 after a historic 65 million token burn fixed its supply at 21 million.

- The X Layer upgrade turned OKB into a gas token for on-chain applications, though adoption and regulatory challenges remain.

The OKB token has stunned the crypto market with a 400% surge to $250 in just one week. This historic rally was fueled by the largest token burn in crypto history and the launch of OKX’s ambitious Layer-2 network, X Layer. Together, these moves reshaped how investors and developers perceive OKB’s long-term value.

OKB Supply Shock: A Historic Burn

On August 15, 2025, OKX executed a monumental burn of 65.26 million OKB tokens, reducing the total supply to just 21 million — permanently fixed. This move was compared to Bitcoin’s hard cap and marked a radical departure from the earlier buyback-and-burn model tied to exchange revenue. By instantly creating scarcity, the burn transformed OKB into a scarce digital asset, sparking a frenzy of demand and lifting its market capitalization to $6 billion.

We are making a strategic upgrade to @XLayerOfficial, aiming to build a leading public chain focused on DeFi, payments, and RWAs.

Key updates:

1️⃣ Underlying tech – PP upgrade

2️⃣ Ecosystem development strategy

3️⃣ Deep integration with OKX Wallet, OKX Exchange & OKX Pay

4️⃣… pic.twitter.com/OU4EpKtuJz— OKX (@okx) August 13, 2025

Demand Driver: The X Layer Upgrade

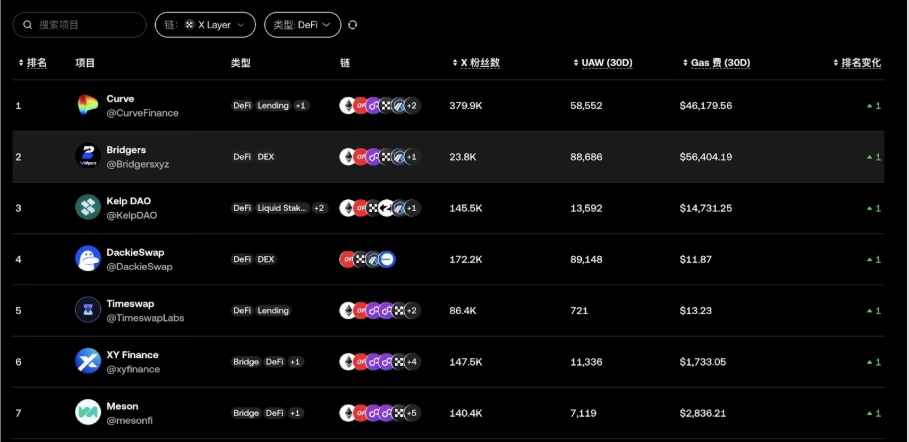

Beyond tokenomics, the launch of X Layer, OKX’s zkEVM-based Layer-2 chain, provided a powerful new demand driver. OKB now functions as the native gas token for the network, supporting decentralized finance (DeFi), payments, and real-world asset tokenization.

Despite impressive early adoption — 13 million transactions and $150 million in activity — X Layer still trails far behind rivals like Arbitrum, BNB Chain, and Polygon in terms of total value locked (TVL). With only $6.5 million TVL, the ecosystem faces challenges in scaling liquidity, onboarding stablecoins, and expanding its DeFi stack.

Comparing OKB to BNB

OKB’s strategic shift mirrors Binance Coin’s path. Both began as exchange utility tokens before evolving into gas tokens for public blockchains. The key difference lies in supply. BNB continues quarterly burns tied to exchange revenue, while OKB has immediately adopted a hard cap at 21 million — a Bitcoin-like scarcity model that could fuel long-term value if adoption grows.

Risks Ahead

Despite its surge, OKB faces risks. RSI readings above 85 signal overbought conditions, while on-chain data shows billions in OKB were deposited to exchanges, suggesting profit-taking. X Layer must also close its ecosystem gaps to compete with major Layer-2s. Meanwhile, OKX still battles regulatory pressures globally, which could slow developer and user adoption.

The combination of a massive supply cut and the rollout of X Layer has redefined OKB’s market position. Once a simple exchange token, it is now viewed as a scarce, utility-driven asset with potential to rival BNB’s success. The key question is whether X Layer can scale fast enough to justify OKB’s newfound premium.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.