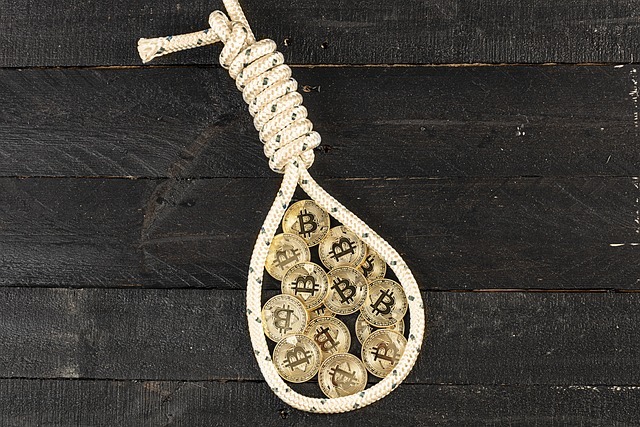

- Ondo Finance is launching a $185 million U.S. Treasury-backed token on Ripple’s XRP Ledger, aiming to enhance institutional access to tokenized assets with faster, 24/7 settlement capabilities.

- This move marks a significant step in bridging traditional finance with blockchain, potentially transforming decentralized finance and treasury management for institutions.

In a groundbreaking move for decentralized finance (DeFi), Ondo Finance has announced the integration of its $185 million U.S. Treasury-backed token on Ripple’s XRP Ledger (XRPL). This initiative revealed on January 29th, 2025, aims to enhance institutional access to tokenized assets through the secure and scalable XRPL blockchain, which has long been recognized for its role in cross-border payments and digital asset custody.

Tokenized U.S. Treasuries: A Game Changer

Ondo Finance is set to launch its Ondo Short-Term U.S. Government Treasuries (OUSG) token, which is backed by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL). The OUSG token allows qualified investors to mint and redeem tokens almost instantly using Ripple’s RLUSD stablecoin, offering an innovative solution for fast, efficient asset transactions. This is expected to unlock a new era of financial management, with institutions able to trade tokenized U.S. Treasuries 24/7—far beyond the limitations of traditional market hours.

According to Ondo Finance, the deployment of this solution will go live within six months, marking a significant milestone in the growing market for tokenized real-world assets.

The Ripple Effect: Bridging Traditional Finance with Blockchain

Ripple’s XRP Ledger has already demonstrated its capability to facilitate cross-border payments and digital asset issuance, but this new development takes things a step further by introducing tokenized assets. RippleX’s Senior Vice President, Markus Infanger, noted the transformative potential of tokenized U.S. Treasuries, emphasizing how they enable intraday settlement, a shift away from slow, traditional settlement processes that hinder capital flow.

This integration brings high-quality liquidity to the DeFi space, while also improving accessibility for institutional investors who have been eyeing decentralized solutions. The XRP Ledger is evolving, with new features such as Multi-Purpose Tokens (MPTs) and Permissioned Domains on the horizon, making it even more attractive for enterprises seeking secure and efficient financial solutions.

The Future of Tokenized Finance

The tokenization of real-world assets has been gaining momentum, with the market for tokenized U.S. Treasury products quadrupling over the past year to $3.5 billion. Ripple’s integration of these assets into its XRPL ecosystem aligns with the broader trend of tokenized finance reshaping traditional markets. This development could also lead to increased interest in Ripple’s own ecosystem, which has seen XRP’s price soar to $3.13 amid a favorable market outlook for 2025.

As Brad Garlinghouse, CEO of Ripple Labs, envisions a U.S. digital asset reserve, the integration of tokenized U.S. Treasuries could pave the way for a new financial paradigm, one where institutions leverage blockchain for high-quality yield opportunities and streamlined treasury management.

In summary, this move by Ondo Finance and Ripple underscores the growing convergence between blockchain technology and institutional finance, heralding a new era of decentralized finance that promises faster, more efficient solutions for asset management. The future of finance is here, and it’s tokenized.