- Dogecoin is seeing strong bullish sentiment as 74.4% of Binance traders hold long positions, supported by positive funding rates and increased long-term holder activity.

- Dogecoin’s recent price dip hasn’t shaken investor confidence, with technical analysis pointing to a possible long-term rally toward $0.70.

Dogecoin has seen a rollercoaster of price movement this April, sparked in part by geopolitical shifts like President Trump’s suspension of tariffs on April 9. The meme-inspired cryptocurrency peaked at around $0.168 on April 13, only to retreat to $0.1541 by April 16. That’s a 3.33% drop in just 24 hours, but it still marks a 7.43% gain over the past week—an impressive stat given the current market climate.

Traders Bet Big on the Bullish Side

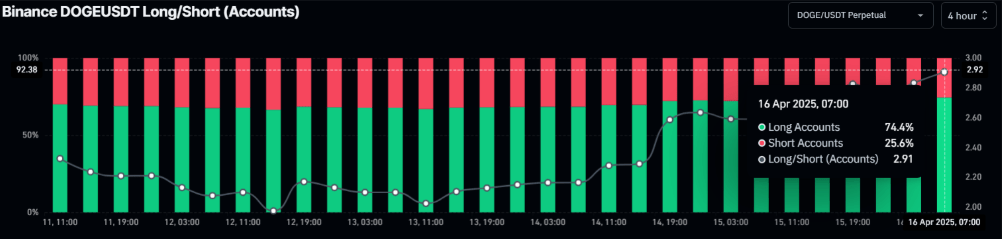

Despite the recent dip, sentiment among traders remains overwhelmingly positive. According to Coinglass data, 74.4% of Binance traders with open Dogecoin positions are going long, leaving just 25.6% shorting the coin. This long-to-short ratio of 2.91 points to solid bullish conviction.

More importantly, the OI-weighted funding rate for Dogecoin has remained consistently positive since April 7. This means that those going long are actually paying to keep their positions open—a clear signal they expect upward momentum to return soon.

Long-Term Holders and Newcomers Align

Further fueling this optimistic outlook is data from IntoTheBlock showing that long-term holders—or “hodlers”—have grown by 0.13%. These are investors who’ve held DOGE for over a year, reinforcing confidence in the coin’s long-term value. At the same time, addresses holding for under a month have surged by nearly 110%, suggesting a fresh wave of interest from newer investors.

Charting the Path Ahead

Technical analysis from TradingView’s FuaCompany shows Dogecoin moving within a rising price channel on the monthly chart. Two possible paths have been identified:

- Bullish Continuation: DOGE bounces off the lower channel boundary and continues climbing, potentially retesting past highs.

- Temporary Breakdown: The price dips below the channel to around $0.08 before making a strong recovery.

Interestingly, both scenarios lead to a potential long-term target of $0.70—more than 350% above current levels.

While the price may be consolidating for now, the numbers behind the scenes tell a more hopeful story. With strong support from both long-term holders and bullish traders on Binance, Dogecoin may just be gearing up for its next big move. Still, investors should keep in mind that the crypto market is unpredictable, and proper risk management is always key.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.