- Pi Network is facing sustained downward pressure, with a 15% monthly decline and negative investor sentiment driven by weak utility and limited exchange support.

- Unless it breaks above $0.8727 and gains stronger market confidence, the token may continue to fall due to its inverse correlation with Bitcoin.

After a tough month marked by a 15% decline, Pi Network enters May 2025 with more questions than answers. The token is currently trading at $0.6077, and its negative momentum is leaving investors on edge.

Selling Pressure Still Dominates

According to the Chaikin Money Flow (CMF) indicator, Pi Network remains under heavy selling pressure. Despite some inflows, the CMF is still below zero, signaling that outflows are dominating. This means investors are pulling money out faster than new capital is coming in—a bearish sign that continues to weigh down the price.

Pi Network’s Struggle with Utility and Trust

Alvin Kan, COO of Bitget Wallet, attributes Pi’s poor performance to deeper issues beyond price. While the project initially gained attention for its unique mobile mining model and vast user base, it hasn’t evolved fast enough to maintain momentum.

“Without strong utility or broader liquidity, investor demand naturally tapered off,” Kan told BeInCrypto.

He added that skepticism surrounding the project’s sustainability and lack of real-world use cases continues to hurt sentiment.

An Inverse Relationship with Bitcoin

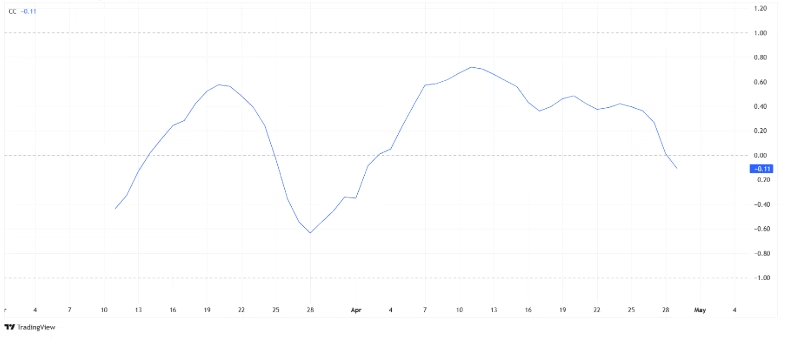

Another key concern is Pi Network’s inverse correlation with Bitcoin. At a correlation of -0.11, Pi tends to decline when Bitcoin rises. With Bitcoin currently nearing the $100,000 mark, this dynamic could spell further trouble for Pi. Rather than benefiting from a broader market rally, Pi might experience more downward pressure as Bitcoin strengthens.

What Needs to Happen for a Reversal?

For Pi to change its current bearish trajectory, it needs to break above the $0.8727 level and turn it into support. If this happens, the next target would be the psychological $1.00 mark, which could restore investor confidence and momentum.

However, failure to hold the $0.6077 level could push Pi toward $0.5192, and potentially even lower to $0.4000—its all-time low. For now, caution remains the best strategy for investors.

While Pi Network showed early promise, its transition from hype to actual value delivery is proving difficult. Unless utility improves and transparency concerns are addressed, the road to recovery will be steep. May 2025 could be a turning point—but only if key resistance levels are broken and investor trust begins to return.