- Pi Network has come under fire after a false claim of a partnership with BNP Paribas was debunked, damaging its credibility.

- The token’s price has dropped over 80% since February, with bearish technical patterns suggesting a possible further 50% decline.

Pi Network has taken a massive hit since its mainnet launch in February 2025, with its value plunging by over 80%. The token’s struggles are largely attributed to misinformation, speculative hype, and concerns about its future, especially with regard to the anticipated Binance listing. Here’s a closer look at the factors contributing to Pi Coin’s current challenges and its potential for further decline.

ALSO READ:How to Buy Pi Coin ( Pi Network ) on Centralized Platforms: A beginners Step-by-Step Guide

Pi Network Faces Struggles Amid Fake News

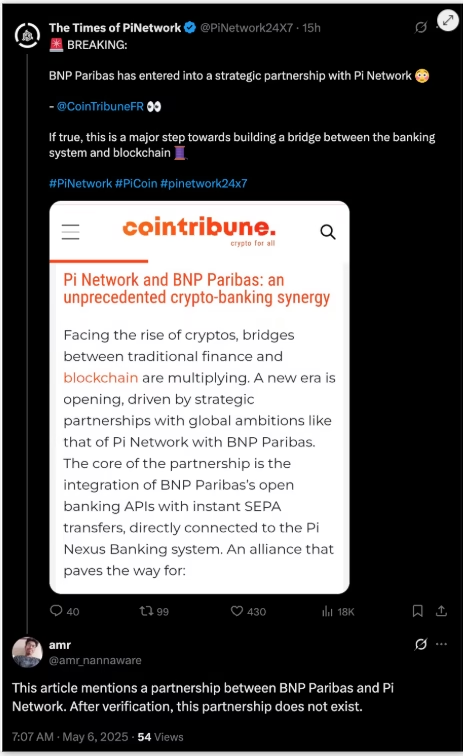

Since Pi Coin’s launch on the mainnet, its price has fallen from $3.00 to a dismal $0.46 by May 6, 2025. A significant factor behind this sharp decline is the spread of fake news. One notable instance is the debunked claim of a partnership with BNP Paribas. This rumor originated from Pi Network groups on X and was fueled by a now-retracted Cointribune article, which cited a GitHub repository as evidence of a “Pi Nexus Banking System” API integration.

The hype surrounding this supposed partnership led many investors to believe in Pi Coin’s potential, causing temporary price surges. However, researchers quickly debunked the claim, revealing that the GitHub file in question was unverified and independent. Despite the misinformation being exposed, Pi Coin’s official channels failed to contain the news, exacerbating the token’s volatility.

The Uncertain Binance Listing

A Binance listing had been a major hope for Pi Coin investors. Back in February 2025, Binance conducted a community vote where 86% of participants supported the token’s listing. Optimism surged, with many expecting Pi’s price to soar to $5 or even $10 if listed. However, despite the strong vote, Binance has yet to confirm any listing.

The lack of a Binance listing is due in part to the project’s centralized nature. Pi Network’s core team controls all mainnet nodes, which raises concerns about decentralization. Moreover, Binance’s new listing rules prioritize projects built on supported blockchains, such as BNB Chain, which Pi does not use. These challenges, along with early miner sell-offs and limited real-world utility, have left Pi Coin in a precarious position.

ALSO READ:Pi Network Raises the Bar with Strict KYB Rules Before CEX Listings

A Potential Further Decline of 50%?

Technical analysis suggests that Pi Coin could face another significant drop in price. A “symmetrical triangle” pattern has formed on Pi’s 4-hour chart, reflecting ongoing indecision in the market. As of May 6, Pi Coin was testing the lower trendline of the pattern at $0.60, confirming a bearish breakdown.

If the pattern plays out, Pi Coin could fall by as much as 50%, with a target price of $0.2965. With both the 50-period and 200-period exponential moving averages (EMAs) trending downward, the bearish momentum shows no signs of slowing down.

Pi Coin’s future remains uncertain as fake news and speculative hype continue to undermine its credibility. The anticipated Binance listing remains a distant hope, and the lack of real-world utility coupled with concerns over its centralized nature may further harm the token’s prospects. For now, Pi Coin faces an uphill battle, with the potential for even further losses on the horizon.

MIGHT ALSO LIKE:XRP Stuck in Tight Range as Network Activity Hits Multi-Month Lows

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.