- Ripple’s potential IPO, expected within 12 to 18 months, could boost its growth by securing more funding and expanding its global payment network, but it may also divert investor attention from XRP.

- While analysts predict XRP’s price could soar to $10–$222, others caution that the IPO might shift focus to Ripple’s stock, affecting the cryptocurrency’s momentum.

The buzz surrounding Ripple’s potential IPO is growing, with investors eager to know when the blockchain-based payment solutions company will go public. While no official date has been set, CEO Brad Garlinghouse has hinted that an IPO is possible but not a priority. However, speculation suggests it could happen by the end of the year or within the next 12 to 18 months.

Why an IPO Could Be a Big Deal for Ripple

Ripple has steadily expanded its presence in the financial sector, gaining institutional adoption globally. By going public, the company could secure additional funding to strengthen partnerships and expand its payment network. With regulatory challenges in the U.S. mostly behind it, Ripple can now focus on new growth strategies.

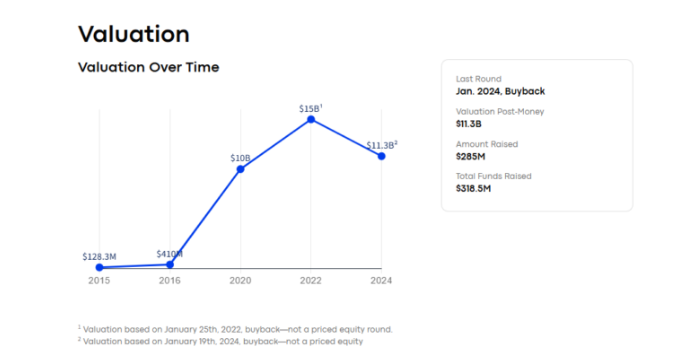

Following its recent buyback in January 2024, Ripple’s valuation stands at $11.3 billion, a drop from its peak of $15 billion in 2022. This buyback raised $285 million, bringing total funding to $318.5 million. With support from major investors like Andreessen Horowitz, Google Ventures, and Founders Fund, Ripple remains a dominant player in digital payments.

RippleNet, powered by the XRP Ledger blockchain, serves as an alternative to traditional cross-border payment systems. With clients such as American Express, Bank of America, Santander, and Standard Chartered, its technology is recognized for enhancing efficiency and reducing transaction costs. The network also provides on-demand liquidity solutions using XRP, a key advantage over competitors.

What the IPO Means for XRP’s Price

For XRP holders, Ripple’s IPO presents both opportunities and potential risks. On the upside, an IPO could boost confidence in Ripple’s technology and increase adoption, potentially driving XRP’s price higher. Analysts such as EGRAG Crypto and ALI Martinez predict that XRP could reach between $10 and $15, while more optimistic projections from Gert van Lagen suggest prices as high as $38 or even $222 under a “Kangaroo phase” theory.

However, some analysts warn that an IPO could shift investor attention toward Ripple’s stock rather than XRP itself, impacting demand for the cryptocurrency. If Ripple’s stock becomes a more attractive investment, XRP might struggle to maintain strong price momentum.

When Will Ripple Go Public?

While industry insiders predict an IPO within 12 to 18 months, Ripple has not confirmed any specific timeline. The company remains focused on its core business and expansion rather than rushing to go public. Still, with all signs pointing toward an IPO being a matter of “when” rather than “if,” investors and XRP holders will be watching closely.

For now, speculation continues, and XRP traders will need to stay vigilant as Ripple’s IPO plans unfold. Whether the IPO brings a surge in XRP’s price or a shift in investor focus remains to be seen.