- Ripple resumed RLUSD stablecoin activity with a 19 million token mint on Ethereum after a 30-day pause, drawing renewed market attention.

- The move comes just days before the U.S. Senate votes on the GENIUS Act, which could tighten stablecoin regulations and impact RLUSD’s future operations.

Ripple has restarted activity on its RLUSD stablecoin with a significant mint of 19 million tokens on Ethereum. This move comes just days before the U.S. Senate is expected to vote on the GENIUS Act—a bill that could bring sweeping changes to how stablecoins operate in the country.

RLUSD Minting Resumes After 30 Days

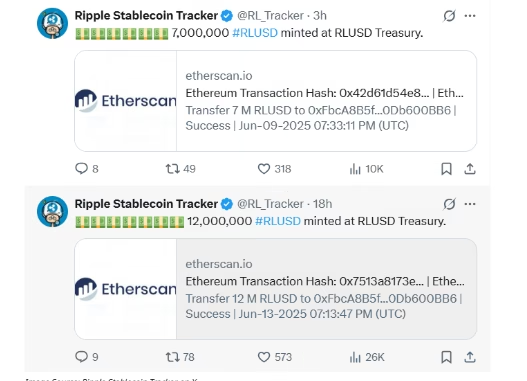

After a quiet period of over a month, Ripple minted 12 million RLUSD tokens on June 13, followed by 7 million more on June 14. The transactions were confirmed on-chain, with minimal gas fees, signaling a low-cost, high-efficiency process. The minting was reported by Ripple Stablecoin Tracker and marked the first major RLUSD issuance since mid-May.

The newly minted tokens were deployed on Ethereum rather than the XRP Ledger. This choice raised questions among XRP supporters, many of whom expected RLUSD to focus on Ripple’s native ecosystem. Despite that, the stablecoin is trading close to its $1 peg at $0.99, with a slight 0.054% increase in the last 24 hours, according to xpmarket.com.

Ripple Prepares for GENIUS Act Impact

The timing of the mint is notable, as the U.S. Senate prepares to vote on the GENIUS Act on June 17, 2025. This legislation could introduce strict requirements for stablecoins, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols—even for users of cold wallets like Xumm.

Ripple appears to be preparing for these changes. RLUSD includes compliance tools such as 1:1 fiat reserves and token-freezing capabilities on the XRP Ledger. Moreover, the stablecoin already operates under New York’s BitLicense, one of the most rigorous crypto regulatory frameworks in the U.S. These steps may position Ripple favorably if the GENIUS Act becomes law.

Market Reaction and Outlook

Despite being slightly depegged, RLUSD continues to see active trading on decentralized exchanges. With over 33,000 wallets holding the token, Ripple’s stablecoin is steadily building traction. Investors are closely watching the Senate vote, as it could reshape the future of RLUSD and influence broader market dynamics.

Ripple’s renewed minting signals confidence in RLUSD’s role in cross-border payments and suggests the firm is ready to compete in a regulated stablecoin market.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.