- Ripple and the SEC have agreed to temporarily postpone the $125 million fine from their lawsuit, causing XRP’s price to drop to $0.54.

- This decline is part of a broader market correction, with XRP potentially extending losses if key support levels are breached.

Ripple’s XRP has seen a significant dip, falling to $0.54, as Ripple and the Securities and Exchange Commission (SEC) jointly agreed to request a stay on the $125 million fine imposed in their ongoing lawsuit. This agreement comes as the broader cryptocurrency market experiences a downturn, further impacting XRP’s price.

On August 7, Ripple filed a letter seeking to temporarily postpone the monetary portion of the court’s judgment in the SEC vs. Ripple case. The SEC consented to this request, and on September 4, a joint filing confirmed the agreement to stay the $125 million fine. This move offers temporary relief for Ripple amid its legal battle with the SEC.

The court case, which concluded with a partial victory for both parties, saw Judge Analisa Torres uphold that XRP is not considered a security in secondary market transactions on cryptocurrency exchanges. However, Ripple was fined $125 million for securities law violations. Ripple’s request for a stay on this fine comes as the company navigates the legal ramifications of the ruling.

The impact on XRP’s price has been notable. The cryptocurrency dipped to $0.54, marking a 1.81% loss on the day. This decline is part of a broader correction in the cryptocurrency market earlier this week. Traders are now closely watching for any signs of an appeal from the SEC, which could further influence XRP’s legal clarity and market performance.

XRP Price Analysis and Future Outlook

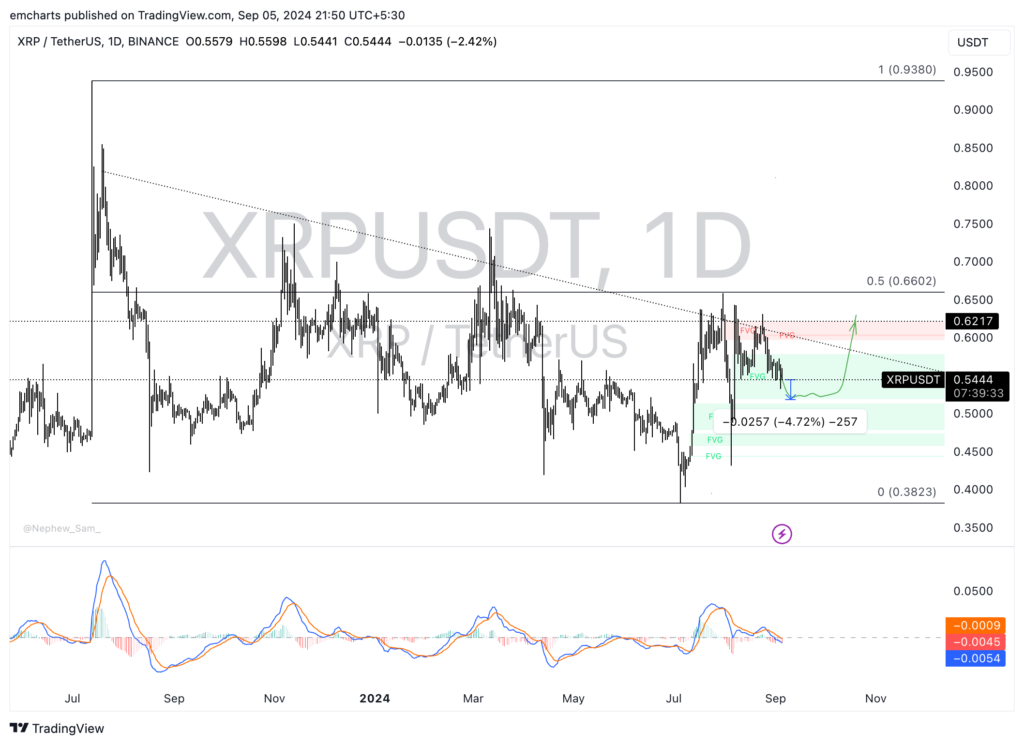

XRP has been on a downward trajectory since mid-July, when it was trading at $0.9380. The current bearish trend suggests that XRP could extend its losses by 4.72%, potentially reaching the key support level of $0.5188. This level is crucial as it represents the lower boundary of a Fair Value Gap (FVG), indicating potential areas of liquidity.

Technical indicators also point to continued bearish momentum. The Moving Average Convergence Divergence (MACD) shows red histogram bars below the neutral line, signaling negative momentum. However, there is a potential for reversal if XRP manages to close a daily candlestick above $0.5785. Such a move could invalidate the bearish outlook and set the stage for a recovery towards the psychologically significant $0.60 level.

As the XRP community awaits further developments, the joint request for a stay on the fine provides a temporary respite. Yet, the uncertainty surrounding a potential appeal and the overall market conditions continue to weigh on XRP’s price. Traders and investors will need to stay vigilant and monitor the ongoing legal proceedings and market trends to navigate the volatile landscape ahead.