- Ripple’s launch of the RLUSD stablecoin on Ripple Payments was overshadowed by President Trump’s tariff announcement, causing XRP’s price to drop 5% and triggering $710 million in realized losses.

- The decline heightened concerns of a bearish trend, despite RLUSD’s promising market adoption and utility in cross-border payments.

Ripple’s recent launch of the RLUSD stablecoin on Ripple Payments was expected to bring significant gains to the XRP ecosystem, but the announcement of new tariffs by President Donald Trump has cast a shadow over these plans. The sudden implementation of a 10% tariff on all US imports and reciprocal tariffs from trading partners triggered a market-wide sell-off, hitting cryptocurrencies hard. As a result, XRP suffered a steep decline, wiping out gains made earlier in the week.

RLUSD Stablecoin Launch: A Promising Start

Ripple’s RLUSD stablecoin went live on Ripple Payments, aiming to enhance cross-border transactions. The integration attracted cross-border payment providers like BKK Forex and iSend, bolstering international treasury operations. RLUSD has rapidly gained traction since its launch in December, boasting a market capitalization nearing $250 million and over $10 billion in trading volume.

Jack McDonald, Ripple’s Senior Vice President of Stablecoins, highlighted RLUSD’s versatile use cases, including its role as collateral in both crypto and traditional finance markets. The stablecoin’s adoption continues to outpace expectations, reinforcing Ripple’s commitment to seamless global payments. RLUSD’s listing on Kraken further strengthens its reach across the crypto space.

Tariffs Trigger XRP Sell-Off and Market Downturn

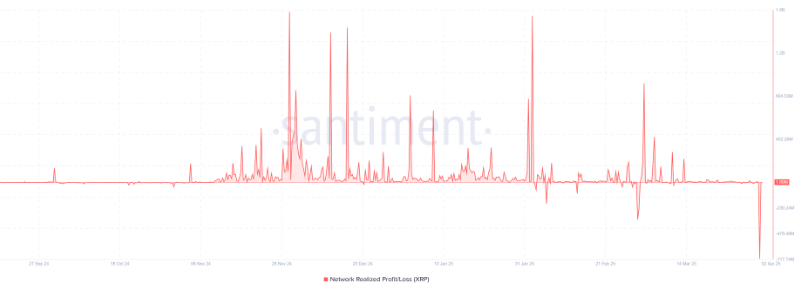

Despite RLUSD’s promising debut, the broader crypto market was blindsided by Trump’s tariff announcement. XRP’s price tumbled by 5% as traders reacted to fears of economic fallout. The market rout led to $710 million in XRP realized losses—the highest since December 2022. Many investors exited positions at a loss, underscoring the intense pressure on digital assets.

The sharp decline also led to $17.26 million in futures liquidations, signaling a potential Head-and-Shoulders (H&S) pattern that could drive XRP prices lower. If XRP falls below the crucial $1.96 support level, the token could see further declines to $1.35. However, a daily close above $2.34 would invalidate this bearish outlook and potentially push XRP to $2.78.

Market Sentiment: A Critical Juncture

The Relative Strength Index (RSI) and Stochastic Oscillator indicate dominant bearish momentum. With sentiment leaning negative, XRP’s price movement hinges on how markets react to ongoing tariff developments. Ripple’s RLUSD launch was a step forward for cross-border payments, but macroeconomic factors now overshadow its impact. Investors will closely watch support levels and regulatory updates as uncertainty grips the crypto market.