- Ripple’s RLUSD stablecoin has nearly 70% of its total supply issued on Ethereum, rather than its native XRP Ledger, raising questions about the strategy behind this cross-chain deployment.

- By launching RLUSD on Ethereum, Ripple aims to expand its reach in the DeFi space, increase liquidity, and position the stablecoin for broader adoption across multiple blockchains.

Ripple’s foray into the stablecoin market with the launch of RLUSD has created significant ripples within the decentralized finance (DeFi) sector. However, recent data has raised questions about the stablecoin’s distribution strategy, revealing that nearly 70% of RLUSD’s total supply is on Ethereum, rather than Ripple’s native XRP Ledger (XRPL). This surprising allocation sparks curiosity about Ripple’s intentions in the stablecoin space and the strategic play behind RLUSD’s cross-chain deployment.

The RLUSD Supply Breakdown: A Shift to Ethereum

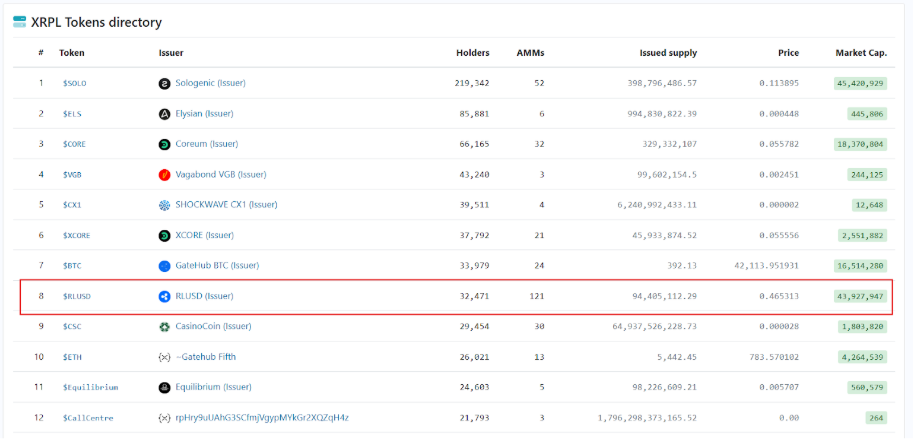

According to on-chain data from Arkham, RLUSD currently has a total supply of 294,042,711 tokens. Despite Ripple’s strong ties to the XRP Ledger, it has issued only 32% of this supply, or 94,405,112 RLUSD tokens, on the XRPL. The remaining 68%, or 199,637,599 RLUSD, is hosted on Ethereum. This large portion of RLUSD on Ethereum, home to major stablecoins like USDT, USDC, and DAI, raises a critical question: Why hasn’t Ripple housed its stablecoin primarily on its own blockchain?

Why Ethereum?

Ethereum remains the most dominant blockchain in the DeFi ecosystem, hosting thousands of decentralized applications (dApps) and offering extensive liquidity pools. This infrastructure provides RLUSD with immediate access to well-established platforms such as Uniswap, Aave, Curve, and MakerDAO. The decision to deploy RLUSD on Ethereum ensures users can trade, lend, or stake the stablecoin across a wide range of decentralized services, increasing its utility and appeal.

Ripple’s cross-chain strategy makes RLUSD more attractive to developers and institutions seeking liquidity and interoperability across blockchains. By placing RLUSD on Ethereum instead of confining it to the XRP Ledger, Ripple taps into a much larger user base and ecosystem, which is vital for the stablecoin’s long-term success.

Ripple’s Multichain Vision: A Strategic Move?

Ripple has long championed the idea of a multichain future, where digital assets can move freely across various blockchains to promote financial inclusion and operational efficiency. The launch of RLUSD on Ethereum aligns with this vision, signaling Ripple’s intention to make the stablecoin usable wherever liquidity exists.

By choosing Ethereum, Ripple can capture market share in the stablecoin-dominated DeFi space, build credibility among DeFi users, and showcase RLUSD’s utility beyond the XRP community. This strategy not only strengthens Ripple’s foothold in DeFi but also paves the way for future cross-chain expansion to other platforms like Solana or Avalanche.

The Road Ahead for RLUSD

The future growth of RLUSD will likely depend on its integration with DeFi protocols, user adoption, and regulatory clarity. However, Ripple’s longstanding reputation in enterprise payments and blockchain solutions could give RLUSD an edge, making it a trusted stablecoin across both retail and institutional markets.

With 70% of RLUSD’s supply currently on Ethereum, Ripple is clearly aiming for a broader, cross-chain future—one where RLUSD plays a pivotal role in the global stablecoin ecosystem. This strategic move could redefine the way Ripple engages with both the DeFi world and the wider cryptocurrency market.