- The article delves into the recent volatility of XRP, exploring its price correction, the significance of the anticipated spot Bitcoin ETF approval, and the potential for a breakout.

- It highlights technical analysis, community sentiment, and legal developments, providing traders with insights to navigate the uncertain cryptocurrency landscape and capitalize on market opportunities.

Cryptocurrency enthusiasts have been closely watching XRP’s recent rollercoaster ride as it underwent a sharp short-term price correction. Despite gaining partial legal clarity that deemed it not a security, the digital asset faces critical moments in the broader cryptocurrency market. With all eyes on the anticipated spot Bitcoin (BTC) exchange-traded fund (ETF) approval, crypto traders are left wondering about the future trajectory of XRP.

Spot Bitcoin ETF Approval – The Make or Break Moment

The approval of a spot Bitcoin ETF is a crucial event that could significantly impact the entire cryptocurrency market, including XRP. Crypto analyst Cryptoinsightsuk highlighted the importance of this event, suggesting that XRP is poised for a breakout. However, investors are advised to monitor various developments closely, especially focusing on XRP’s weekly close above the pivotal $0.5636 level.

Technical Analysis and Historical Patterns

According to Cryptoinsightsuk, the technical characteristics of XRP resemble those of previous bear markets, notably the pattern observed in 2021. A breakthrough after testing the $0.56 range as resistance, followed by consolidation, historically led to a breakout. The current tight consolidation structure in XRP is considered more bullish than that seen in 2017 from a technical standpoint.

“Shitcoin that Never Moves”: A Contrarian Indicator

Within the XRP community, a sense of capitulation is noted, with emotions running high as some express frustration with what they term a “Shitcoin that never moves.” Cryptoinsightsuk sees this emotional response as a potential contrarian indicator, suggesting that extreme sentiment often precedes a market reversal. Traders are reminded that buying during times of fear rather than greed can be profitable.

Legal Status and SEC Battle

Despite the ongoing legal battle between Ripple and the Securities Exchange Commission (SEC), XRP is legally not considered a security in the United States. Recent selling by holders may be attributed to the cloud over XRP lifting after almost three years, as individuals sought to exit the asset at break-even or a slight loss of around $0.90. As XRP targets a return to $1, the outcome of the SEC case remains pivotal for the token’s value.

Current State and Future Prospects

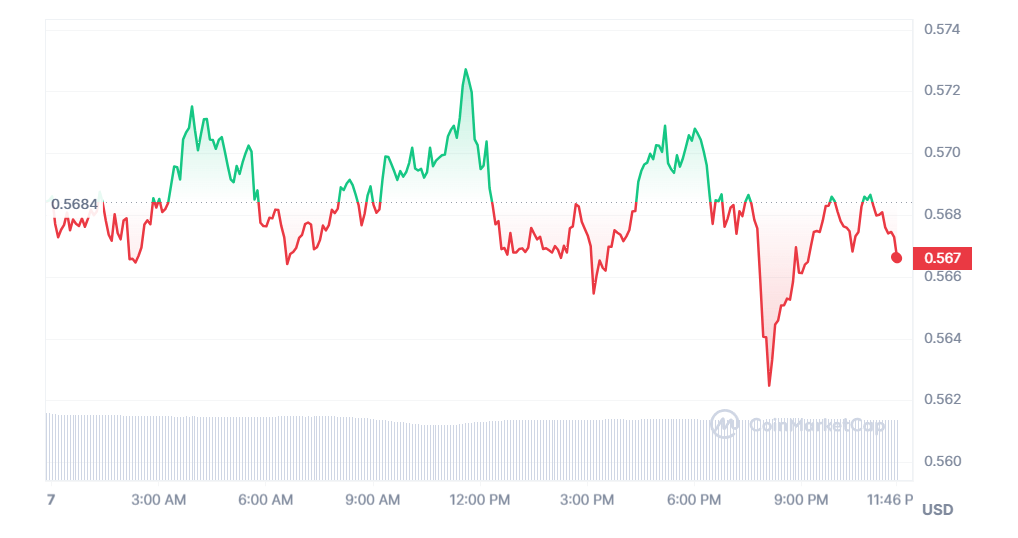

By press time, XRP is trading at $0.57, experiencing a correction of nearly 10% over the past seven days. Technical indicators suggest a prevailing bearish sentiment, with a ‘sell’ rating of 10 in one-week gauges. As the focus shifts to XRP reclaiming the $0.60 spot and targeting the broader goal of hitting $1, traders must navigate through the uncertainty, keeping a close eye on market dynamics and regulatory developments.

Navigating Volatility: Strategies for XRP Investors

Amid market turbulence, XRP investors should stay vigilant and consider adopting strategic approaches to navigate the volatility effectively. The coming weeks may unveil unprecedented opportunities, and understanding the interplay between technical analysis, community sentiment, and regulatory developments is key to making informed decisions in this ever-evolving crypto landscape