Chainlink Cryptonewsfocus.com

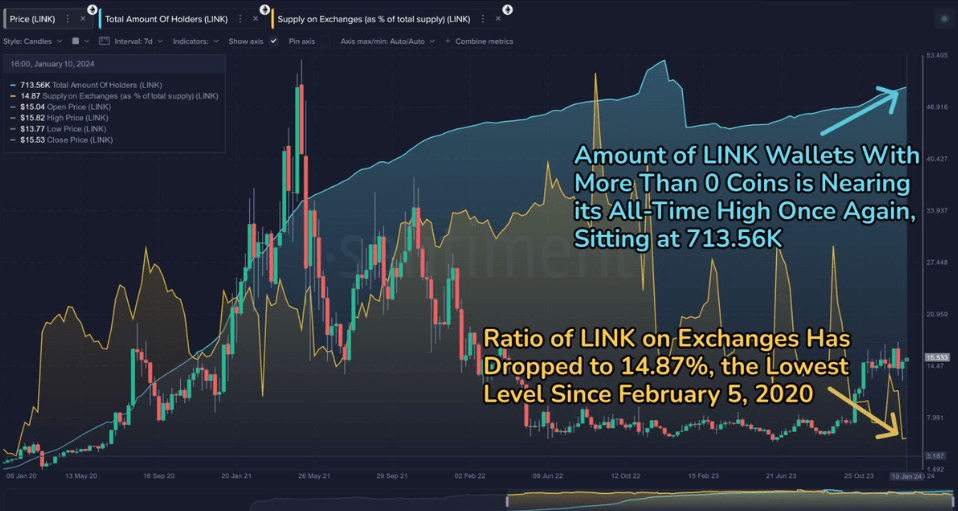

- Chainlink (LINK) is experiencing a significant drop in supply on cryptocurrency exchanges, reaching its lowest level since February 2020.

- Simultaneously, the number of unique LINK addresses holding a positive amount of coins is nearing an all-time high, indicating growing adoption and interest in the decentralized oracle provider.

Decentralized oracle provider Chainlink (LINK) is making waves in the crypto space, and it’s not just about its recent mini breakout to $15.82. According to blockchain analytics platform Santiment, two critical metrics are signaling bullish trends for Chainlink, pointing towards a potential surge in value and heightened investor interest.

Vanishing Act on Exchanges

One striking observation by Santiment is the dwindling supply of Chainlink on cryptocurrency exchanges. The overall supply has reached its lowest point since February 2020, falling below 15%. This marks a significant shift in the Chainlink landscape, hinting at a possible tightening of available tokens in the market. The last time Chainlink’s exchange supply was at this level was approximately four years ago, underlining the rarity of the current scenario.

Wallets Holding LINK: Nearing All-Time Highs

In addition to the disappearing act on exchanges, Santiment highlights another compelling factor – the surge in the number of unique LINK addresses holding a positive (non-zero) amount of coins. This metric is approaching an all-time high, with a mere 6% gap to its historical peak. Such a surge in non-zero wallets signifies growing adoption and interest in Chainlink, as more investors are choosing to hold and engage with the cryptocurrency.

Chainlink, currently trading at $15.08, has experienced a nearly 1% increase in the last 24 hours, further emphasizing the positive sentiment surrounding the asset.

Riding the Post-ETF Approval Wave

Santiment’s insights extend beyond Chainlink, shedding light on broader market trends following the recent approval of spot Bitcoin exchange-traded funds (ETFs). The approval has triggered bullish sentiment for major cryptocurrencies like Bitcoin, Ethereum, and XRP, while some competitors face a bearish outlook.

“As [last weekend] kicked off, sentiment toward top cap assets remain at extremely optimistic levels with spotlights on them following the ETF approvals. Traders are particularly bullish toward Ethereum after its market value climbed above $2,700 for the first time since May 2022.”

Overlooking Cardano: A Shift in Trader Optimism

While optimism surrounds Bitcoin, Ethereum, and XRP Network, Santiment notes a conspicuous shift in sentiment towards Cardano (ADA). Despite its usual level of trader optimism, Cardano is being somewhat overlooked in discussions. This may indicate a diversion of attention, possibly influenced by the heightened interest in other cryptocurrencies, including Chainlink.

Chainlink’s diminishing supply on exchanges and the surge in non-zero wallets point towards a bullish trajectory. As the broader crypto market reacts to the approval of spot Bitcoin ETFs, Chainlink seems to be carving its own path, capturing the attention of investors and enthusiasts alike. The current dynamics suggest that Chainlink might be gearing up for more than just a mini breakout, presenting a compelling opportunity for those closely watching the evolving crypto landscape.