- Shiba Inu burn rate surged by 10,845%, removing over 9.5 million SHIB from circulation and sparking a mild price uptick.

- Despite early bullish signals, low trading volume and exchange delistings leave the token’s recovery uncertain.

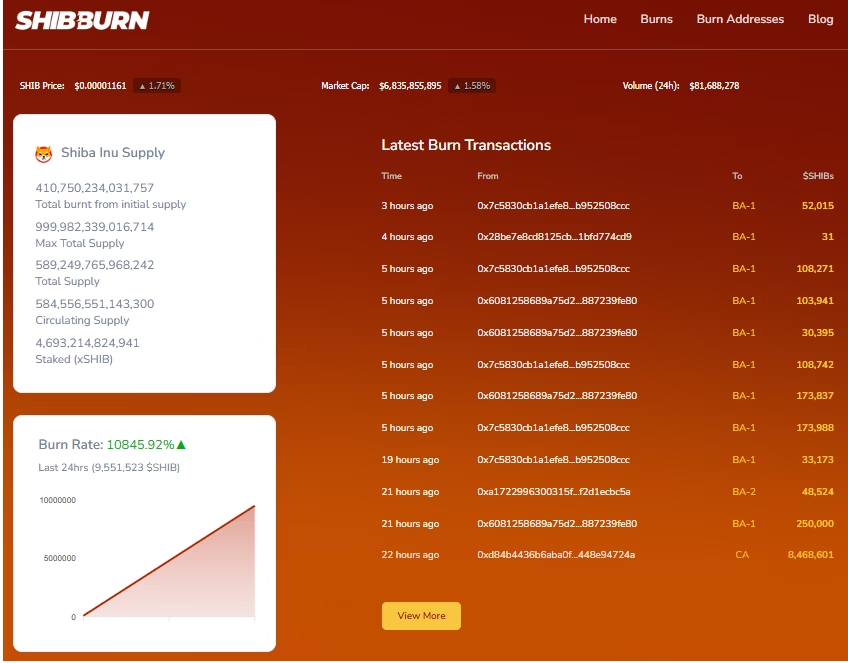

Shiba Inu (SHIB) has reignited its deflationary mechanism with a dramatic surge in its token burn rate—soaring by 10,845% in just 24 hours. This spike, driven by the SHIB community, saw over 9.5 million tokens permanently removed from circulation, signaling a renewed effort to create scarcity and potentially boost the meme token’s price.

Shiba Inu Community Pushes for Scarcity

At the heart of this burn event is SHIB’s long-term strategy: reducing circulating supply to create value. With the total supply sitting at over 589 trillion SHIB, this burn might seem small. However, consistent efforts like these could gradually make a more significant impact on SHIB’s market value over time.

The recent action reduced the circulating supply to approximately 584.5 trillion SHIB, excluding staked tokens. Such burns, while incremental, are essential in the broader plan to drive demand and encourage price recovery.

SHIB’S Price Sees Modest Recovery, But Volume Dips

Following the burn, SHIB’s price rose by 3.66% to $0.00001186, recovering from a low of $0.00001135. Technical indicators also showed early bullish signs, with SHIB’s Relative Strength Index (RSI) climbing out of oversold territory—hinting at a potential upward trend.

Despite the uptick, trading volume declined by over 21%, settling at $83.93 million. This signals that while price action improved, traders are still cautious and waiting for further confirmation of a breakout. If SHIB can break through key resistance levels at $0.00001210 and $0.00001250, the token could aim for a move above $0.000013.

Shiba Inu Faces Exchange Delistings Amid Price Rally

In parallel, the SHIB ecosystem dealt with the news of two centralized exchanges delisting the token. SHIB’s marketing lead, Lucie, downplayed the impact, calling it manipulative and urging the community to focus on long-term goals. She encouraged users to rely less on centralized exchanges and trust the ongoing development within the SHIB ecosystem.

Outlook: SHB’S Burn and Bullish Indicators Could Drive Future Gains

If the SHIB Army sustains its burn efforts and technical trends continue to improve, SHIB may be poised for a more robust recovery. However, trading activity must pick up for the rally to gain real strength. Until then, SHIB’s short-term future hangs in the balance—supported by scarcity but still needing a volume boost to break out convincingly.

ALSO READ:Terra Classic Forecast: Why LUNC Might Triple by 2030

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.