- Solana is trading between $165 and $170 as it consolidates within a key range, supported by major protocol upgrades, rising institutional interest, and increased ecosystem value.

- Despite whale transfers and resistance near $180–$190, the network’s technical improvements and positive market signals suggest a bullish potential.

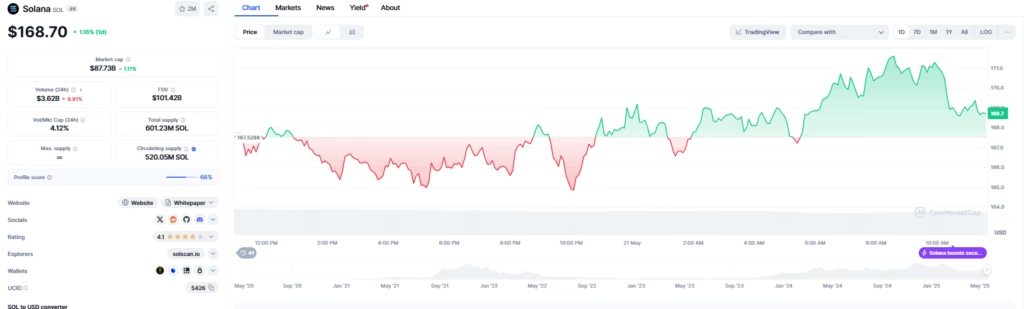

Solana is once again at a pivotal price level, trading between $165 and $170 after a modest 3% gain that followed a 6% dip. This back-and-forth signals a broader battle as bulls and bears wrestle for control, with the $160–$180 range acting as a consolidation zone. As the altcoin trades sideways, key developments in technology, institutional adoption, and whale activity are steering its course.

ALSO READ:SEC Delays XRP and Dogecoin ETFs Again, Seeks Public Input

Alpenglow Upgrade Shakes Up Solana Core

A major technical upgrade is now reshaping Solana’s consensus model. Anza, a Solana-focused research firm, has rolled out Alpenglow, a significant shift from the old Tower BFT and Proof of History system to a new architecture: Votor and Rotor.

- Votor simplifies block finality, requiring only one round of voting when 80% of the stake participates.

- Rotor reduces network latency by flattening the communication tree, improving overall speed.

These changes aim to bolster Solana’s performance as adoption and use cases grow.

Institutional Momentum Builds with Galaxy Digital

Institutional interest is heating up. Galaxy Digital has partnered to launch tokenized equities on Solana’s blockchain, a move that could draw traditional finance deeper into the crypto space.

Meanwhile, the total value locked (TVL) across Solana-based protocols has jumped from $7 billion in April to over $10 billion, signaling rising user and developer confidence in the ecosystem.

Although the U.S. SEC has delayed decisions on Solana spot ETF applications, the passage of the Genius Act in the Senate has improved the regulatory outlook, especially for stablecoins and tokenized assets.

ALSO READ:Pi Network Price Prediction: A Wake-Up Call for Early Miners

Whale Transfers and Technical Outlook

Despite bullish developments, not all is calm. Whales have moved millions of dollars worth of SOL from Binance to external wallets, raising questions about market intent. Still, support at $160 remains intact.

Chart watchers note a falling wedge pattern on the 4-hour chart, often seen as a bullish setup. However, strong resistance persists at $180–$190, a zone that previously capped upward moves.

Solana’s price may be stuck in a range for now, but strong fundamentals, ecosystem upgrades, and growing institutional involvement are forming a supportive foundation. As Bitcoin eyes new highs in 2025, Solana could be well-positioned for its next leg up—provided it can break past that stubborn $180 ceiling.

MIGHT ALSO LIKE:Ripple Aggressive Bid Puts Pressure on Coinbase in Race to Acquire Circle (USDC)

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.