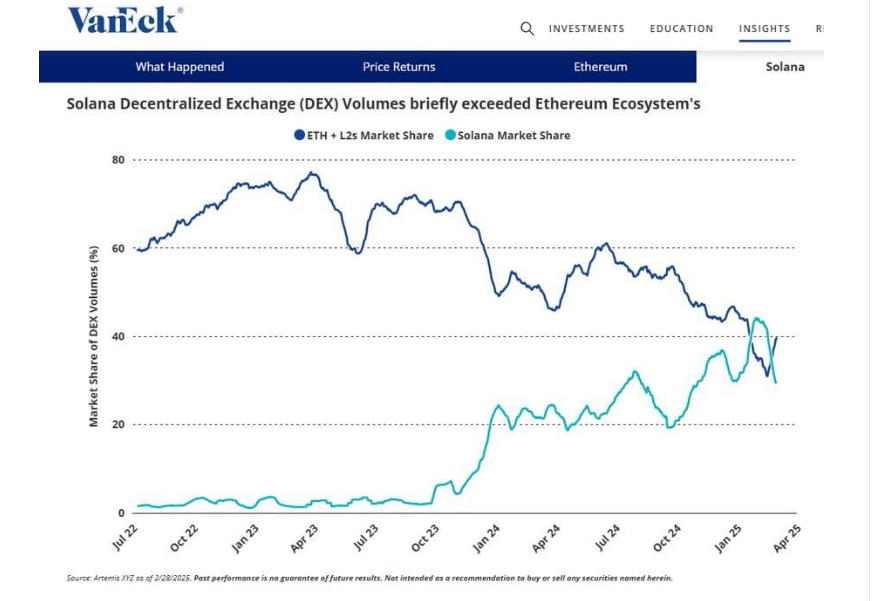

- Solana’s DEX trading volume surged to 43% in February 2025, briefly surpassing Ethereum’s ecosystem due to its faster and lower-cost transactions, despite a downturn in the memecoin market.

- Although its market share dipped to 30% in March, Solana’s growing presence in DeFi challenges Ethereum’s dominance, signaling its potential for long-term expansion.

Solana’s decentralized exchange (DEX) market has taken the crypto world by storm, surpassing Ethereum’s ecosystem in trading volume for the first time. In February 2025, Solana’s DEX market share spiked to 43%, outpacing Ethereum’s Layer-1 and Layer-2 solutions combined. This milestone signals a shift in decentralized finance (DeFi), as traders increasingly opt for Solana due to its lower costs and faster transaction speeds.

Solana’s February Boom: A Temporary Lead Over Ethereum

According to a March 5 report by VanEck, Solana’s DEX trading volumes reached a record high in February, surpassing Ethereum’s ecosystem. Despite the memecoin market’s downturn, Solana’s presence in DeFi remained robust, reflecting its growing appeal among traders.

However, by March, Solana’s DEX market share slipped to 30%, trailing Ethereum’s 40%. Even with this dip, Solana’s February dominance highlighted its rising influence in the crypto trading space. Traders are drawn to its efficient and low-cost transactions, making it a formidable competitor to Ethereum.

Memecoin Collapse and Its Impact on Solana

The memecoin market experienced a major shake-up in February, impacting trading sentiment across the crypto space. High-profile crashes, including the Trump Coin collapse and the failure of the Libra project, led to a sharp decline in trading activity. On-chain stablecoin transfers—a crucial part of decentralized trading—dropped by 80% compared to January.

Despite these setbacks, Solana’s DeFi ecosystem demonstrated resilience. Pump.fun, a leading memecoin platform, remained a key revenue driver despite seeing an 80% drop in new token launches. Meanwhile, Raydium, one of Solana’s top DEX platforms, continued to operate steadily with over $1.3 billion in Total Value Locked (TVL), reinforcing confidence in Solana’s trading infrastructure.

Solana vs. Ethereum: The DeFi Battle Heats Up

Ethereum has long been the leader in DeFi, backed by a vast developer community, established protocols, and deep liquidity. However, Solana’s rapid growth presents a challenge to Ethereum’s dominance. Analysts note that Solana’s superior transaction speeds and lower fees make it an attractive alternative, particularly for traders seeking efficiency and cost-effectiveness.

In January 2025, Solana DEX platforms outperformed Ethereum Virtual Machine (EVM)-based DEXs in trading volume for the first time. Some experts now argue that Solana’s Virtual Machine (SVM) could rival Ethereum’s EVM in the long run. While Ethereum still holds a significant advantage in total value locked (TVL) and institutional adoption, Solana’s trajectory suggests that its ecosystem may be undervalued, pointing to substantial growth potential.

The Future of Solana in DeFi

Solana’s impressive performance in the DEX market indicates that it is not just a fleeting competitor but a serious contender in the DeFi space. Its ability to sustain high trading volumes despite market fluctuations suggests strong developer and user confidence. With its efficient infrastructure and increasing adoption, Solana could continue to challenge Ethereum’s long-standing dominance, reshaping the future of decentralized finance.