- Brazil’s approval of a Solana ETF and the rising supply of PayPal’s PYUSD stablecoin on the Solana network are fueling hopes for a SOL price rally to $175.

- Key resistance levels at $150 and $175 will be crucial in determining the cryptocurrency’s upward momentum.

The cryptocurrency market is buzzing with anticipation as recent developments surrounding Solana (SOL) have sparked hope for a potential price rally. Key factors, including Brazil’s approval of a Solana Exchange-Traded Fund (ETF) and the increasing supply of PayPal’s PYUSD stablecoin on the Solana network, are driving optimism among traders and investors alike.

Brazil’s Solana ETF Approval: A Gateway to Global Adoption?

Brazil’s Securities and Exchange Commission recently approved a Solana spot ETF, a move that could have far-reaching implications beyond its borders. This decision positions Brazil as a potential trendsetter, with markets in the US and UK closely monitoring the situation. Asset managers like VanEck and Standard Chartered have hinted at the possibility of similar ETFs being launched in the US by 2025. Such products could significantly enhance the visibility and adoption of Solana’s ecosystem, attracting institutional and retail investors globally.

PayPal’s PYUSD Stablecoin Dominates Solana Network

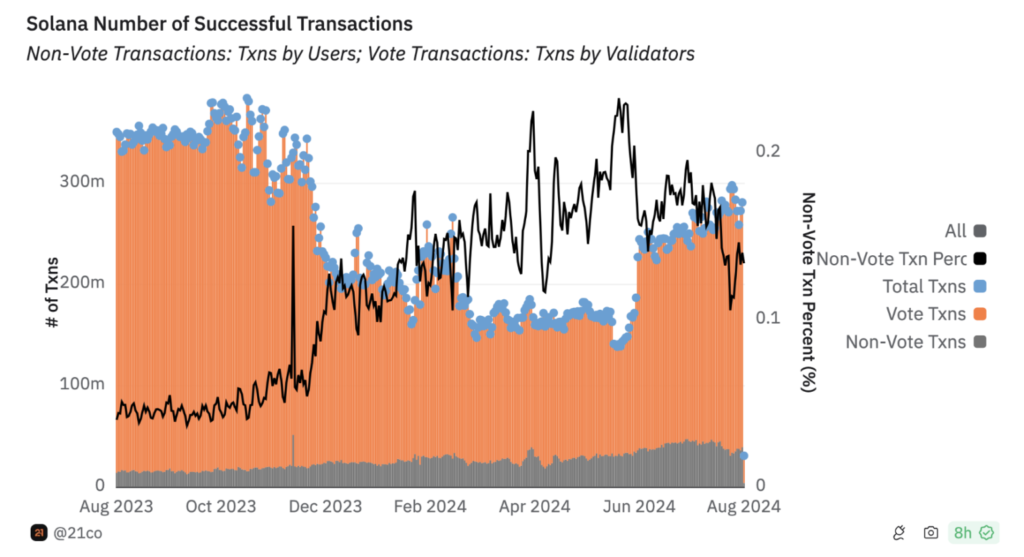

Another critical factor contributing to the bullish sentiment around Solana is the increasing supply of PayPal’s PYUSD stablecoin on its network. Recently, the supply of PYUSD on Solana surpassed $377 million, outpacing its presence on the Ethereum network. This milestone highlights the growing confidence in Solana’s infrastructure, particularly its ability to handle high transaction volumes efficiently. The rising transaction volumes are a clear indicator of increased trader interest, further solidifying Solana’s position in the competitive cryptocurrency landscape.

Technical Analysis: Key Resistance and Support Levels

Despite recent price declines in the broader crypto market, Solana has shown resilience, trading sideways since its March 18 peak of $210.18. The current focus is on whether SOL can break through key resistance levels. The first hurdle is at the psychological level of $150, followed by a more significant resistance at $175, which has been a crucial level since mid-April.

The Relative Strength Index (RSI) for Solana stands at 44.13, suggesting indecision among traders. At the time of writing, Solana is trading at $145.07, reflecting a 0.79% decrease in the past day and a 4.71% decline over the past week. However, if the bullish momentum continues, driven by the ETF approval and the surge in PYUSD supply, Solana could be on track to challenge the $175 resistance level.

A Bullish Outlook for Solana?

With Brazil’s pioneering move and PayPal’s increasing reliance on Solana, the stage is set for a potential price rally. While challenges remain, especially in breaking through key resistance levels, the fundamentals appear strong. Traders and investors will be watching closely to see if Solana can capitalize on these developments and reach the much-anticipated $175 target.