- Solana (SOL) is experiencing a sharp decline due to the upcoming March 1 token unlock, reduced blockchain activity, security concerns, and broader market downturns, with its price potentially dropping further to $110.

- However, if SOL regains support at $177, it may have a chance to recover toward $215.

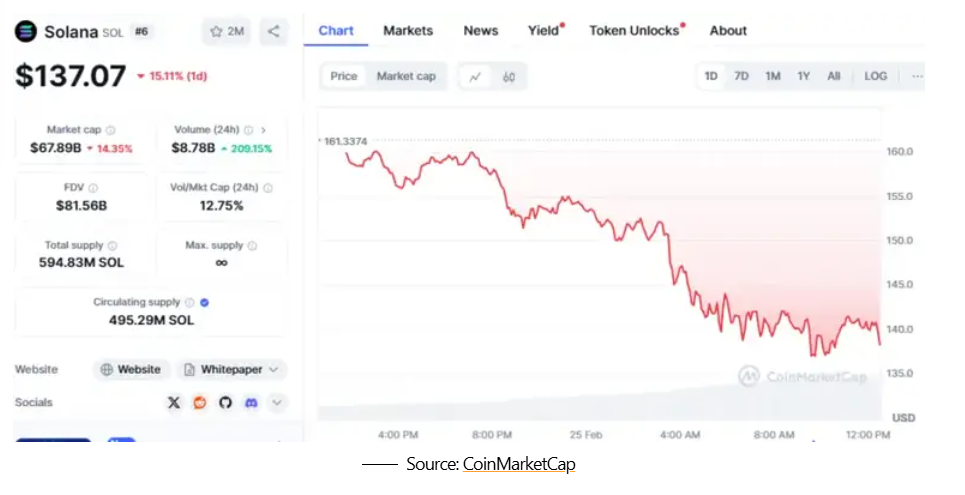

Solana (SOL) is experiencing a steep decline, with its price falling below $140 after struggling to maintain levels above $150 just a day ago. Over the past month, SOL has lost nearly 45% of its value, leading to increased concern among investors. With further downside potential, many are wondering what’s behind the crash.

The Impact of the March 1 Token Unlock

A major factor driving Solana’s decline is the upcoming token unlock scheduled for March 1. Around 11.2 million SOL tokens, valued at approximately $1.79 billion, will be released into the market, primarily from the FTX estate. This massive supply increase has sparked fears that heavy selling by FTX creditors could further push prices down. If these large holders decide to liquidate their assets, it could significantly impact Solana’s price in the short term.

Decline in Meme Coin Activity on Solana’s Blockchain

Just a few months ago, Solana’s blockchain was thriving due to a surge in meme coin projects. In January, these tokens had a combined market value of $25 billion, but that figure has since dropped to $9.8 billion. Popular tokens like Dogwifhat and Official Trump have lost billions in value. As interest in meme coins declines, network activity on Solana has slowed, reducing overall demand and weakening SOL’s price.

Bearish Technical Signals

Solana has also faced bearish chart patterns, reinforcing its downward trajectory. The token recently broke a crucial support level at $169 and formed a ‘death cross,’ a technical pattern where the short-term 50-day moving average falls below the 200-day moving average. This is a strong signal that bearish sentiment is dominating the market, making further declines likely. If the selling pressure continues, SOL could drop another 30%, reaching around $110.

Security Concerns and Investor Caution

Security issues have added to Solana’s woes. The network has been linked to multiple high-profile hacks and scams, eroding investor trust. These include:

- North Korea’s Lazarus Group’s involvement in the $1.4 billion Bybit hack.

- Wallets used in the Bybit hack also being linked to Solana-based scams like the Pump.fun rug pull.

- The $107 million Libra token scam, which further damaged confidence in Solana’s ecosystem.

These repeated security breaches have made investors more cautious, reducing capital inflows and weakening SOL’s price even further.

Broader Market Downturn

Solana’s struggles are part of a larger market decline. Bitcoin (BTC) has dropped 7% to $89,347, Ethereum (ETH) has fallen 9% to $2,490, and XRP is down 10% to $2.25. During market downturns, altcoins like Solana tend to suffer the most due to their higher volatility, compounding its current price drop.

What’s Next for Solana?

Solana’s near-term future remains uncertain. If it fails to find strong support, further declines are likely. However, if it can stabilize around $177, there is potential for a recovery toward $215. All eyes are now on the March 1 token unlock event, which could determine Solana’s next major price movement.

For now, investors should brace for continued volatility as the market reacts to the influx of new SOL tokens and broader bearish sentiment.