- Solana has reached record highs in network activity and total value locked, showing strong user engagement.

- However, major holders are unstaking and moving millions of SOL to Binance, signaling increased sell pressure despite the positive on-chain metrics.

Solana (SOL) is showing impressive network growth, but behind the scenes, large holders are quietly selling significant amounts of the token. This contrast raises questions about the future outlook for Solana’s price and ecosystem.

Record On-Chain Activity Signals Strong Network Use

In recent weeks, Solana has recorded its highest ever monthly non-voted transaction count, with transactions per second (TPS) averaging 1,318 — a new all-time peak. This surge highlights strong user engagement and growing adoption of Solana’s blockchain technology.

🚨BREAKING: Monthly non-voted transactions on @Solana hit a new all-time high in July. True TPS also averaged 1,318, the highest ever recorded. pic.twitter.com/MPqnExdcgy

— SolanaFloor (@SolanaFloor) August 5, 2025

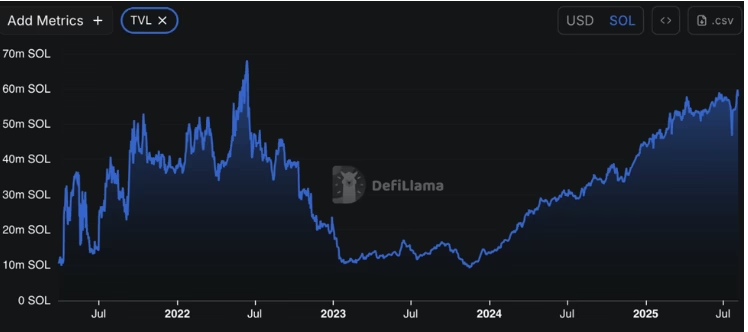

At the same time, Total Value Locked (TVL) in Solana’s native token SOL has reached its highest level in over three years. TVL measures how much value is committed to decentralized finance (DeFi) protocols on the network, suggesting that users and projects are increasingly relying on Solana for financial services and applications.

Whales Unstake and Move Millions to Binance

Despite the positive on-chain data, large Solana holders — often called whales — are showing signs of caution. Notably, Galaxy Digital unstaked 250,000 SOL (worth around $40.7 million) and transferred it to Binance. Another whale moved nearly $5 million worth of SOL after a period of inactivity, with some addresses moving more than $30 million in total in recent months.

Galaxy Digital unstaked 250K $SOL($40.7M) and deposited it into #Binance 3 hours ago.https://t.co/2lK98Kbv6T pic.twitter.com/FzUJy4PBDL

— Lookonchain (@lookonchain) August 6, 2025

These large transfers to Binance, a major cryptocurrency exchange, often precede selling activity. The movement of millions in SOL by whales suggests growing sell pressure even as the network’s usage metrics hit new highs.

Price Lags Amid Competition and Delays

While network activity is strong, Solana’s price has struggled, down roughly 30% year-to-date. The crypto market’s competitive landscape is intensifying, with platforms like Hyperliquid DEX gaining traction. Additionally, delays in Solana’s technical roadmap may be causing uncertainty among investors.

The mixed signals — strong on-chain metrics alongside rising whale sell-offs — paint a complex picture. It remains to be seen whether this represents a healthy rotation of capital or a warning sign for Solana’s near-term price performance.

Solana’s all-time highs in usage and TVL show a resilient blockchain ecosystem, but large holders moving tens of millions of SOL to exchanges highlight risks of mounting sell pressure amid stiff competition and technical challenges.