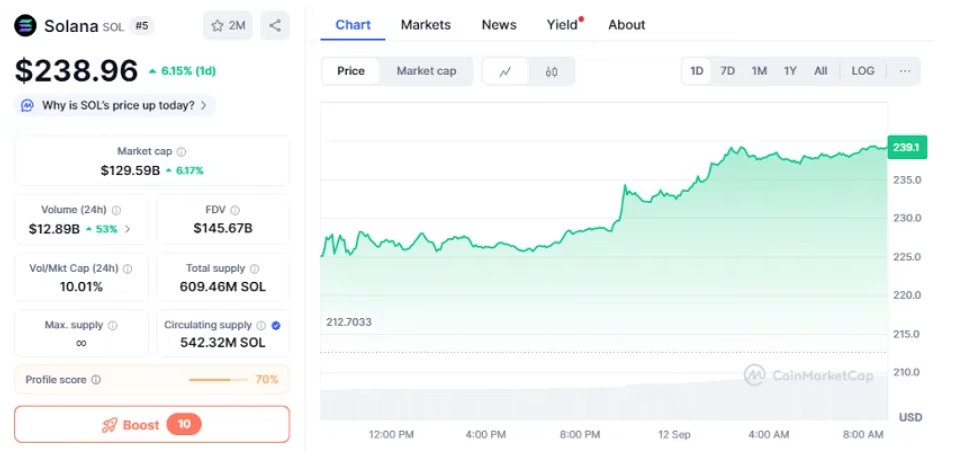

- Solana surged 6% to $238.96 after Galaxy Digital acquired 2.31 million SOL tokens worth $536 million. The move highlights rising institutional adoption as companies embrace Solana-based treasury strategies and staking initiatives.

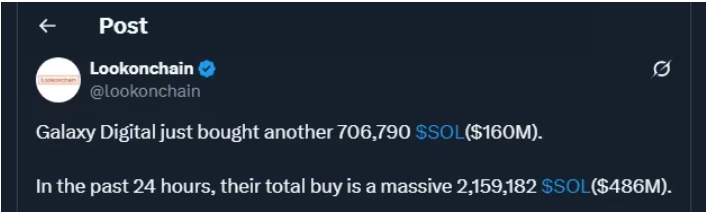

Solana has taken another big step into the spotlight after Galaxy Digital purchased 2.31 million SOL tokens valued at $536 million.

The on-chain transfers, flagged from Binance, Bybit, and Coinbase, sparked strong market speculation and drove Solana’s price up 6% to $238.96 at press time. With this jump, Solana’s market cap reached $129.59 billion, surpassing Binance Coin (BNB) to secure the fifth spot among cryptocurrencies.

Galaxy Digital’s Expanding Solana’s Strategy

This isn’t Galaxy Digital’s first major bet on Solana. The acquisition follows a recent $300 million commitment to Forward Industries, a publicly traded company shifting its business model to focus on Solana-based digital asset treasuries. Alongside Jump Crypto and Multicoin Capital, Galaxy played a key role in a $1.65 billion private placement that fueled Forward’s transformation.

The market responded quickly, with Forward’s shares surging 135% in less than a week. Analysts suggest Galaxy’s growing exposure to Solana reflects a larger strategy: building substantial on-chain positions in networks viewed as faster, cheaper alternatives to traditional blockchains.

Institutional Adoption of Solana Treasuries

Galaxy’s purchase highlights a broader shift among institutions. More companies are adopting Solana as part of their treasury strategies, signaling strong confidence in the blockchain’s future. BIT Mining Limited recently rebranded as SOLAI Limited, acquiring over 44,000 SOL and launching its own Solana-based stablecoin, DOLAI. Similarly, Upexi Inc. now manages more than 2 million SOL, earning daily staking rewards of over $100,000.

Industry leaders, including Galaxy CEO Mike Novogratz and Bitwise CIO Matt Hougan, have praised Solana’s scalability, efficiency, and regulatory outlook. Their confidence suggests Solana could remain a key part of institutional crypto portfolios for years ahead.

Solana’s Rising Role in Crypto

With corporate treasuries, institutional acquisitions, and staking initiatives fueling demand, Solana’s position in the market is stronger than ever. Galaxy Digital’s $536 million bet reinforces the growing conviction that Solana is more than just a fast network—it’s becoming a foundation for large-scale institutional adoption.

As institutional interest deepens, Solana appears well positioned to continue its rise among the top digital assets.

ALSO READ:Pi Network Reaches 12 Million Mainnet Users as Protocol 23 Upgrade Nears

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.