- Solana is facing challenges in maintaining its $100 support due to the economic uncertainty caused by tariff tensions, despite the introduction of its new Confidential Balances feature.

- This privacy upgrade, aimed at attracting DeFi projects and institutional players, could help Solana recover if market conditions improve and the price rebounds.

Solana (SOL) has been struggling to maintain its $100 support level amidst macroeconomic challenges, including the escalating tariff tensions introduced by former U.S. President Donald Trump. The cryptocurrency market, like other global markets, faces significant uncertainty as the U.S. government intensifies its trade disputes with China, weighing down investor sentiment. However, there is a glimmer of hope for Solana, not just from its resilient technical patterns but also from the introduction of new privacy features aimed at attracting institutional players.

Solana’s Confidential Balances: A Game-Changer for Privacy and DeFi

Solana’s Confidential Balances, an evolution of its original Confidential Transfers feature, could be the key to enhancing the network’s appeal to decentralized finance (DeFi) projects. The update expands privacy features, including hidden token transfer amounts, confidential fees, and confidential mint and burn capabilities. By using advanced cryptographic techniques such as homomorphic encryption and zero-knowledge proofs (ZKPs), Solana aims to offer the privacy benefits needed to compete with other privacy-focused blockchains.

These updates are expected to play a crucial role in attracting more DeFi projects and institutional participants who seek enhanced privacy while complying with regulatory standards. Solana developers are also working on integrating these features into the popular Phantom wallet, further streamlining adoption. While the current rollout is based on Rust, a JavaScript version is expected in 2025.

Solana’s early "Confidential Transfers" feature has evolved into "Confidential Balances," a suite of advanced privacy extensions covering confidential transfers, fees, minting, and burning, enabling asset issuers to conceal amount details without compromising compliance.…

— Wu Blockchain (@WuBlockchain) April 9, 2025

Liquidation Fears and Tariff Impact on Solana’s Price

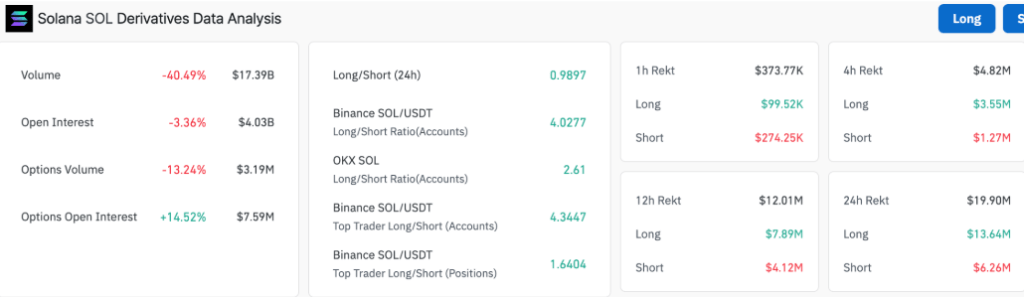

Despite the promising update, Solana’s price has been under pressure due to the broader market sell-off triggered by Donald Trump’s tariff policies. With $19.9 million in liquidations across Solana derivatives in just 24 hours, it’s clear that market participants are feeling the heat. The open interest in Solana derivatives has also fallen by 3.36%, signaling a cautious sentiment and risk-off behavior from traders.

Currently trading around $105, Solana is grappling with macroeconomic headwinds, and its ability to maintain the critical $100 support level will be tested in the coming days. If Solana fails to hold above $100, the next support zone could be at $75, where bulls might look for a rebound.

Technical Outlook: A Potential Breakout for Solana

On the technical front, a falling wedge pattern on Solana’s daily chart hints at a potential rebound of nearly 30% if the pattern is validated. A breakout could push SOL toward the $140 range, provided the broader market sentiment improves and tariff-related volatility subsides.

Can Solana Defend $100?

Solana’s journey to reclaim stability amid tariff-induced volatility is not without challenges. However, the enhancements to its privacy features through Confidential Balances could play a significant role in its long-term success. If it can maintain its $100 support and navigate the economic uncertainties, Solana may be poised for a strong recovery once market conditions improve.