- Solana price bounced back slightly after Janover, a small Wall Street-listed firm, announced its plans to accumulate SOL tokens as part of a new digital asset strategy.

- Despite the price drop, Solana’s network remains strong, with high transaction volumes on decentralized exchanges and continued interest in its ecosystem.

Solana (SOL) is back in the spotlight this week after bouncing off recent lows, sparking debates on whether the rally is a genuine turnaround or just a dead cat bounce. Fueling the excitement is an unexpected move from a small publicly traded company—Janover Inc.—which has begun accumulating SOL tokens as part of a bold digital asset strategy.

Janover Steps Into Crypto with a Solana-Focused Strategy

Janover, a company better known for its commercial property and business loan services, made headlines by announcing its new leadership team and a fresh strategy centered around digital assets. The firm, now under the helm of Joseph Onorati as CEO and Parker White as Chief Investment Officer, is pivoting away from traditional real estate and diving into crypto—starting with Solana.

In a move reminiscent of MicroStrategy’s early Bitcoin adoption, Janover secured $42 million from big-name investors like Kraken, Pantera, and Protagonist. Rather than using the funds for their core business, the company plans to allocate them toward digital assets, with a primary focus on Solana. Onorati emphasized Solana’s utility and scalability as key reasons for the investment, calling it a layer-1 network capable of supporting a wide range of decentralized applications (dApps).

Solana’s Network Shows Strength Despite Price Dip

Despite Solana’s price recently plunging from nearly $300 to just over $110, the network itself remains impressively resilient. Over the past month, Solana’s decentralized exchanges (DEXs) processed more than $45 billion in volume, trailing only behind Ethereum. Platforms like Orca, Meteora, and Pump continue to see strong usage, with Orca alone handling over $11.5 billion in transactions.

Solana also remains a significant player in the NFT space, processing over $40 million in NFT volume in the last 30 days—even as that market contracts.

Technical Signals Remain Mixed

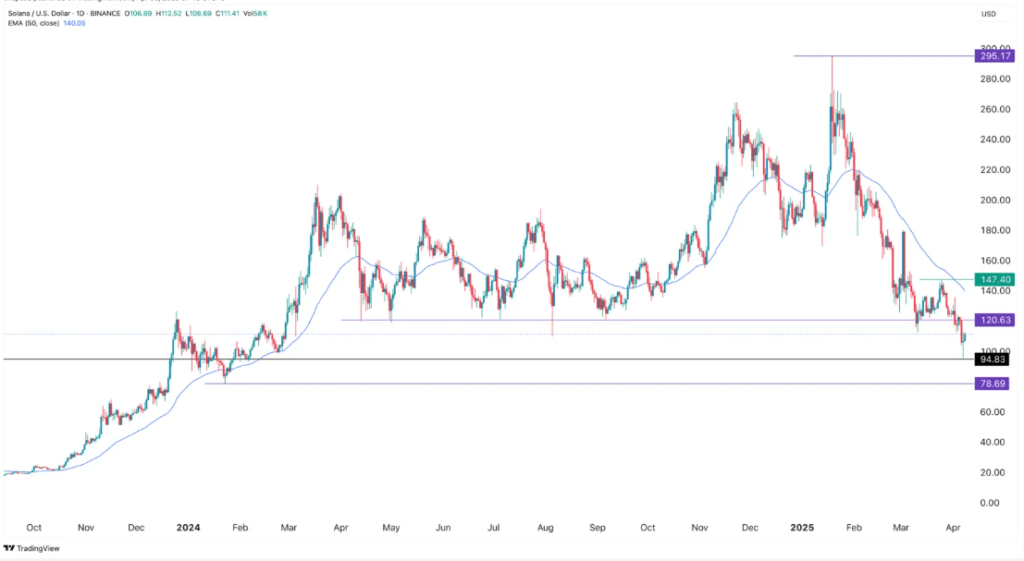

On the technical side, Solana formed a doji candlestick pattern after hitting a low of $94.83, which is often seen as a bullish reversal signal. However, SOL remains below the $120 resistance level, a key barrier it has failed to break repeatedly. If the rally falters, analysts warn that the price could slide back to $80. A true bullish breakout would only be confirmed with a move above $147.

Janover’s entrance into the Solana ecosystem has brought renewed attention to the token. While the network fundamentals are strong, and institutional interest is a bullish sign, technical indicators suggest caution. Whether Solana’s latest bounce is the start of a sustained uptrend—or just a temporary lift—remains to be seen.