- Solana (SOL) has surged past $130 as Volatility Shares LLC prepares to launch the first-ever Solana futures ETFs, signaling growing institutional interest and a potential pathway to a spot ETF approval.

- Despite recent market volatility, Solana’s strong fundamentals, rising Total Value Locked (TVL), and thriving ecosystem position it for further price gains, with analysts eyeing a possible return to $170.

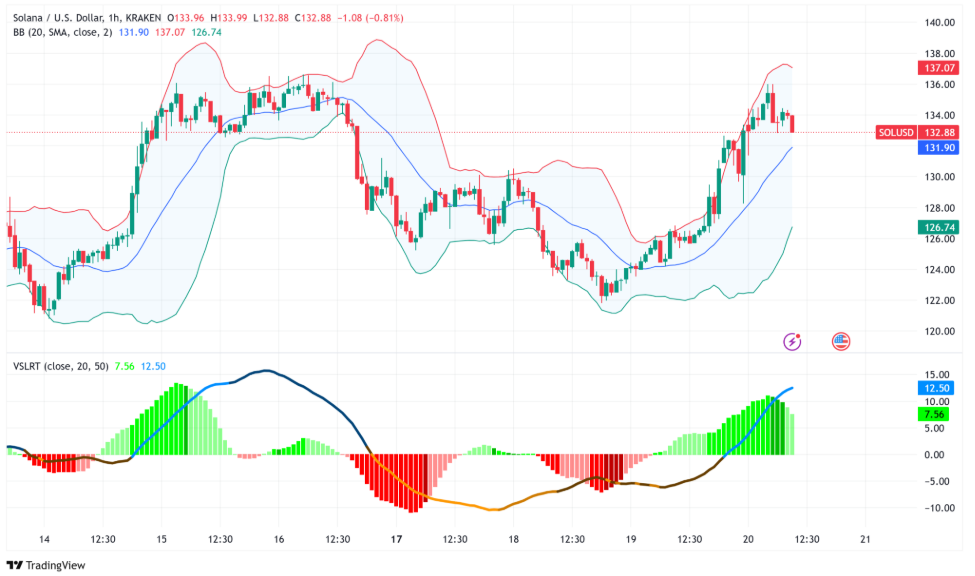

Solana (SOL) has been on an impressive rally, surpassing the $130 mark with a 6% gain in the last 24 hours. This surge coincides with a major milestone for the blockchain ecosystem—the launch of the first-ever Solana futures ETFs. As Volatility Shares LLC gears up to introduce these ETFs on March 20, the move signals a growing institutional interest in Solana, further strengthening its position in the cryptocurrency market.

Solana Futures ETFs: A Gateway to Institutional Investment?

Volatility Shares LLC is set to launch two futures-based ETFs: the leveraged Volatility Shares 2X Solana ETF (SOLT) and the Volatility Shares Solana ETF (SOLZ). These funds will track Solana futures contracts, which recently debuted on the Chicago Mercantile Exchange (CME) with an opening trading volume of $12.1 million. While this figure trails behind Bitcoin’s $102 million and Ethereum’s $30 million, it marks a significant step forward in Solana’s development as an institutional-grade asset.

Industry experts believe that the success of these ETFs could pave the way for a spot Solana ETF approval, with Bloomberg Intelligence analysts estimating a 75% probability of approval by year-end. This would further legitimize Solana as a mainstream financial asset, potentially attracting a broader range of investors.

Strong Fundamentals Despite Market Fluctuations

Despite experiencing a 27% price drop over the past month, Solana has shown remarkable resilience. The network’s Total Value Locked (TVL) surged to 53.2 million SOL, reflecting a 10% increase from the previous month and reaching levels not seen since July 2022. In nominal terms, Solana’s TVL now stands at $6.8 billion, surpassing Binance’s BNB Chain, which holds $5.4 billion.

Solana’s growing ecosystem continues to thrive, with key decentralized applications (DApps) leading in fee generation and user engagement. Some of the most notable performers include:

- Pump.fun – A memecoin launchpad

- Jupiter – A decentralized exchange

- Meteora – An automated market maker

- Jito – A staking platform

Interestingly, Solana’s weekly base layer fees have now exceeded Ethereum’s, a remarkable feat given Ethereum’s much larger TVL of $53.3 billion.

Market Sentiment and Future Price Projections

Market analysts suggest that Solana’s price may be poised to retest the $170 level, last seen on March 3. This optimism is driven by several key factors:

- Strong network deposits despite overall market volatility

- Neutral to positive sentiment in the derivatives market

- Reduced SOL token supply increases over the coming months

Although 2.72 million SOL is set to be unlocked in April, the rate of new supply will decrease significantly, with only 0.79 million tokens being released across May and June. This reduction in selling pressure could support a steady price climb.

Looking Ahead: A Favorable Environment for Solana?

The broader financial market trends may also benefit Solana. With investors shifting towards risk assets ahead of Federal Reserve Chair Jerome Powell’s statements, expectations of a softer inflation outlook for 2025 could further fuel interest in cryptocurrencies like Solana.

As institutional adoption continues to grow and Solana maintains its strong on-chain fundamentals, the blockchain’s future looks promising. Whether it can sustain its momentum and break past its previous highs remains to be seen, but the current trajectory suggests a bright outlook for Solana and its investors.