- Solana’s revenue has plummeted 90% since January due to a sharp decline in memecoin trading, transaction fees, and Total Value Locked (TVL), with its token, SOL, dropping 60% amid broader market turmoil.

- The blockchain now faces uncertainty as it seeks to pivot beyond speculative trading to regain investor confidence.

Solana, once the darling of the cryptocurrency world, is facing a dramatic downturn. The blockchain, which surged in popularity thanks to memecoins and strong trading activity, has seen its revenue collapse by 90% since January. With declining transaction fees, a shrinking Total Value Locked (TVL), and a struggling token price, the ecosystem is experiencing its toughest period in recent months.

The Numbers Behind the Crash

At its peak in mid-January, Solana was generating a staggering $38.5 million per week in revenue. Fast forward to March, and that figure has dwindled to just $4 million per week. Transaction fees, a key revenue driver for Solana, have plunged, with the network now bringing in around $8 million per week—the lowest since September 2024.

Meanwhile, Solana’s TVL, a critical metric indicating the amount of capital locked in its decentralized finance (DeFi) protocols, has also taken a significant hit. From over $12 billion in January, it has now shrunk to approximately $6.4 billion, reflecting a 50% decline.

The Memecoin Fallout

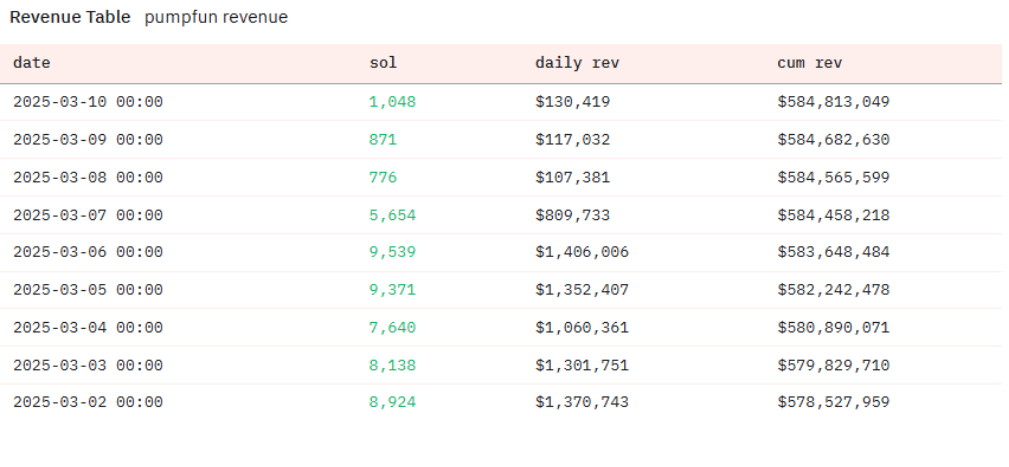

One of the primary catalysts behind Solana’s explosive growth—and its subsequent decline—has been the memecoin frenzy. At its peak, memecoin trading, particularly on the Pump.fun platform, accounted for 80% of Solana’s revenue. However, the collapse of notable memecoins like TRUMP, LIBRA, MELANIA, and ENRON has triggered a steep decline in trading activity.

Pump.fun, which once raked in $15 million in daily revenue in late January, now sees a mere $107,000 per day—a staggering 95% drop. With the overall memecoin sector losing 68% of its value since December, it’s evident that the hype-driven market has cooled down significantly.

The Broader Market Impact

Solana’s struggles are not happening in isolation. The entire crypto market is experiencing turbulence, exacerbated by macroeconomic concerns. Bitcoin, the industry bellwether, has fallen nearly 30% from its all-time high of $109,000, dipping below $80,000. This broader downturn has contributed to reduced investor appetite for risk, further hurting Solana’s market position.

The price of Solana’s native token, SOL, has mirrored this decline. After reaching an all-time high of $295 on January 19, SOL has plummeted 60%, now trading around $120. Analysts suggest that traders became overly euphoric during the market’s peak, ignoring warning signs about increasing market manipulation within the Solana Virtual Machine (SVM) ecosystem.

What Lies Ahead for Solana?

While Solana’s revenue remains higher than its lowest points in late 2024, the current downturn raises questions about the sustainability of its growth model. With memecoins no longer providing the same level of trading volume and market sentiment remaining uncertain, the blockchain must pivot towards more stable and long-term revenue streams to regain investor confidence.

Solana’s future now hinges on its ability to attract new use cases beyond speculative trading. Whether it can weather this storm and reclaim its former glory remains to be seen.