- Stellar (XLM) is gaining bullish traction as Open Interest rises by 40% and Ripple’s legal case nears dismissal.

- Technical indicators suggest XLM could rally to $0.51 if buying pressure continues.

Stellar (XLM) is riding a wave of bullish sentiment, boosted by both technical signals and a major legal development involving its long-time rival, Ripple. With XLM surging nearly 15% over the past two days, traders are eyeing a potential rally to $0.51, supported by increased market activity and renewed investor confidence.

Ripple’s Legal Breakthrough Ignites Stellar’s Rally

Ripple’s joint filing with the U.S. Securities and Exchange Commission (SEC) for case dismissal in their years-long battle has sent a ripple effect across the crypto market—quite literally. While XRP itself surged on the news, Stellar, often seen as its direct competitor in the cross-border payments space, also benefitted from the improved sentiment.

Investors interpreted the legal development as a green light for greater regulatory clarity in the sector. This optimism has helped push XLM up by nearly 5% on Friday, following a 10% surge the previous day.

Open Interest in XLM Jumps by 40%

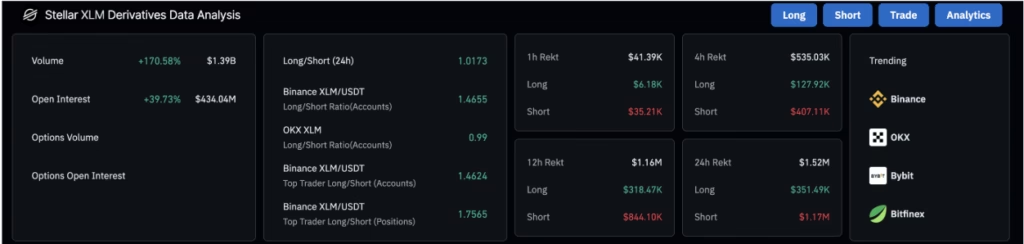

Data from CoinGlass reveals a notable 40% rise in XLM’s Open Interest, now sitting at $434.04 million. This marks a significant influx of capital into futures and options contracts tied to the token. Meanwhile, short liquidations hit $1.17 million compared to just $351,490 in long positions, showing bears were caught off guard by the sharp rally.

The long-to-short ratio now stands at 1.0173, reinforcing the view that bulls are in control and eyeing further gains.

Stellar Technical Indicators Align for a Breakout

XLM’s recent breakout from a falling channel pattern adds more strength to the bullish outlook. The token has surpassed the key 50% Fibonacci retracement level of $0.4389 and is now aiming for $0.4834, the 78.6% level. A successful breakout above this could propel the price to the previous high of $0.5166—an 11% climb from current levels.

The 50-day EMA is trending toward the 100-day EMA, suggesting a potential Golden Cross—an event typically seen as a strong buy signal. The RSI hovering at 76 also signals heavy buying pressure, although overbought conditions warrant caution.

Stellar appears to be riding both a technical and sentimental wave, with bulls charging ahead. If the current trend holds, the $0.51 mark is well within reach. However, failure to maintain upward pressure could see a fallback to the $0.4389 support zone.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.