- Stellar (XLM) is showing signs of recovery after dropping to $0.2177, supported by strong technical confluences and growing investor accumulation.

- Analysts project potential breakout targets at $0.4122, $0.5262, and $0.6659 if the bullish trend continues.

After weeks of turbulent trading driven by broader market pressures, Stellar (XLM) is flashing bullish signals that could lead to a strong reversal. From its recent low of $0.2177, XLM has started showing signs of recovery, and analysts believe a surge toward $0.6659 may be underway.

Strong Technical Setup Bolsters Stellar Outlook

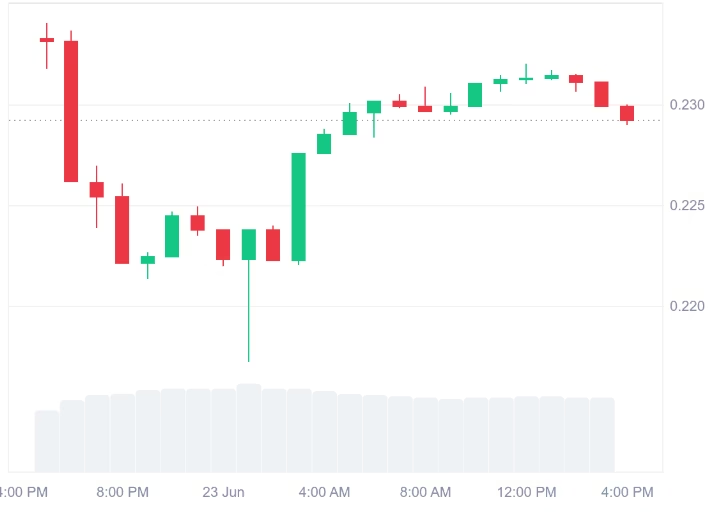

Currently trading around $0.2292, Stellar’s price action is drawing attention due to a critical convergence on the weekly chart. A long-term ascending trendline intersects with a horizontal support zone, forming a technical confluence that typically precedes major price shifts. This alignment is being closely watched as a key springboard for upward momentum.

Despite a 12.88% decline in the past seven days and a minor 1.47% dip in the last 24 hours, analysts see this as part of broader market volatility rather than a sign of weakness. With market conditions stabilizing and accumulation signals rising, investor interest in XLM appears to be growing.

Three Key Targets on the Horizon for Stellar

Prominent analyst BitMonty points to three crucial price levels if XLM continues to rally:

- $0.4122: The first resistance point in the short term

- $0.5262: A historical pivot and significant midpoint

- $0.6659: The key level that marks a potential full bullish breakout

These targets are aligned with Fibonacci retracement levels and past market structure points, offering clear checkpoints for traders and investors monitoring Stellar’s next moves.

Accumulation Suggests Rising Demand

Market behavior in the current support range hints at active accumulation, with buyers likely stepping in at key technical levels. If these supports hold and broader crypto sentiment improves, XLM could begin a more sustained rally toward the projected upside targets.

In a market still cautious due to Bitcoin’s recent weakness, Stellar’s setup stands out. If the bullish scenario plays out, XLM might not just recover recent losses—it could also test new highs unseen in months.

ALSO READ:Ondo and Stellar: The Perfect Crypto Pairing for 2025

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.