- XLM has dropped over 25% since mid-May, falling below the key $0.26 support level, but rising social sentiment and positive funding rates suggest a possible reversal.

- With geopolitical tensions easing and potential network developments ahead, Stellar’s XLM may be poised for a recovery if market conditions align.

After a steep 25% drop since mid-May and an intraday slide of 7%, Stellar’s native token XLM is trading at $0.249—just below the crucial $0.26 support level. The drop has triggered concern, especially as the bearish trend has been persistent since early June. However, despite this decline, new signals from on-chain data and social sentiment offer a glimmer of hope for a potential turnaround.

Bullish Signals Emerge from Social Sentiment and On-Chain Metrics

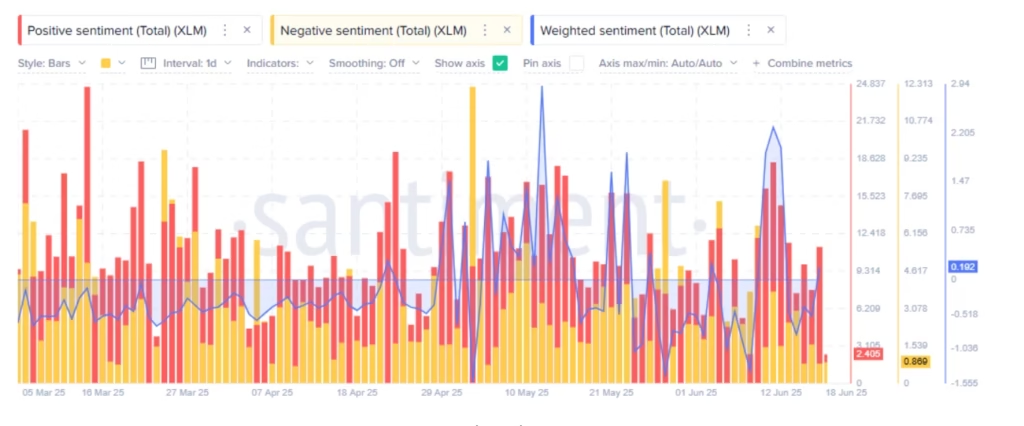

One of the most telling signs of a shift comes from Santiment data, which shows a rise in XLM’s total weighted sentiment from -0.775 to +0.192 this week. On June 17 alone, positive social mentions surged to 11.31, far outpacing negative ones. This change suggests a growing bullish bias among retail investors and online traders.

Additionally, XLM’s derivatives market is signaling early recovery signs. Open Interest (OI) weighted funding rates, which stood at -0.378% in mid-May, have flipped positive, now at +0.0029%. This implies traders are increasingly betting on a price upswing, even though it has yet to reflect in the spot market.

Developments That Could Fuel a Breakout

Part of this renewed optimism stems from recent announcements regarding Stellar’s ecosystem. The planned integration of PayPal’s PYUSD stablecoin aims to support small and medium-sized enterprises with affordable cross-border payments. There’s also speculation about an upcoming collaboration with EasyA. While these developments have not yet triggered a price rally, they lay the groundwork for future upside potential.

What Could Trigger the Next XLM Price Move?

From a technical standpoint, XLM hovers near the bottom of a falling wedge—a classic reversal pattern.

A peaceful resolution to geopolitical tensions, particularly the Israel-Iran conflict, could act as a key catalyst. Also, if today’s FOMC meeting signals dovish outcomes, the broader crypto market might see renewed bullishness, which could lift XLM as well.

While Stellar’s price currently faces resistance, the combination of improving sentiment, growing derivatives interest, and network developments positions XLM for a potential breakout—provided external conditions align.

ALSO READ:Will Pi Network Hold $0.51 or Slip Toward New Lows?

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.