- Strategy, led by Michael Saylor, purchased 4,980 Bitcoin for $531.1 million, pushing its total holdings to 597,325 BTC.

- The firm’s year-to-date gains and rising yields reflect strong confidence in Bitcoin as prices surged past $107K.

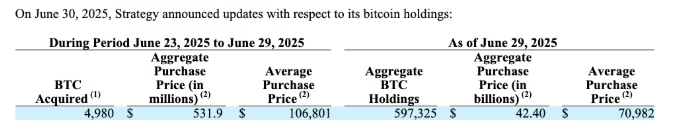

Michael Saylor’s firm, Strategy, has added 4,980 Bitcoin (BTC) to its portfolio, spending $531.1 million in its latest purchase. This acquisition, made during the final week of June, came as Bitcoin’s price climbed from $101,000 to over $108,000, reflecting a surge in investor sentiment.

Strategy Now Holds 597,325 BTC

Following this purchase, Strategy’s total Bitcoin holdings now stand at 597,325 BTC. These were acquired for about $42.4 billion at an average price of $70,982 per coin. In 2024 alone, the firm has gained 85,871 BTC — worth roughly $9.5 billion — showcasing a steady growth trend.

Strategy’s Bitcoin yield also continues to rise. The year-to-date (YTD) yield has now reached 19.7%, just shy of the company’s 25% target by the end of 2025. The quarter-to-date yield has also edged up to 7.8%, underlining consistent performance.

Bitcoin Transfers Suggest Custody Optimization

Blockchain data revealed that Strategy moved 7,383 BTC — valued at around $796 million — to three new wallets. Analysts believe these transactions were carried out to enhance the company’s custody practices. According to Lookonchain, this aligns with Strategy’s historically secure and disciplined approach.

The firm has largely followed a buy-and-hold strategy. Aside from a brief trade in December 2022, when it sold 704 BTC and quickly repurchased 810 BTC, Strategy has maintained its long-term holding pattern.

Long-Term Vision Behind the Strategy

Michael Saylor remains firm in his commitment to Bitcoin. In a reposted 2020 interview, he emphasized his long-term outlook, saying he’s buying Bitcoin not just for now but for future generations. This mindset continues to shape Strategy’s approach, even as BTC’s price surges.

As Bitcoin gains strength and institutional interest grows, Strategy’s consistent buying behavior could signal deeper market confidence in the digital asset.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.