- Terra Classic (LUNC) has faced significant challenges but remains a cryptocurrency of interest, with its price prediction for 2025 ranging from $0.00002372 to $0.00037801 depending on market sentiment and technological advancements.

- While short-term volatility is expected, LUNC’s long-term prospects could see it surpassing its previous all-time high if future upgrades succeed.

The world of cryptocurrency is unpredictable, and Terra Classic (LUNC) has certainly had its share of highs and lows. Once a major player in the crypto space, LUNC experienced a significant crash during the 2022 bear market. However, it has made efforts to regain its momentum, and investors are keen to know what the future holds. In this article, we will delve into Terra Classic’s price prediction for 2025 and beyond, using technical analysis to gauge potential price movements.

The Rise and Fall of Terra Classic (LUNC)

Terra Classic was launched by Do Kwon’s Terraform Labs in 2019 as a proof-of-stake blockchain. Initially, it supported the Terra ecosystem with its algorithmic stablecoin, TerraUSD (USTC). After the fall of USTC and the collapse of Terra’s algorithmic model, a new blockchain called Terra (LUNA) emerged. However, Terra Classic continues to hold a place in the crypto community, despite the challenges it has faced.

Terra Classic’s Current Market Position

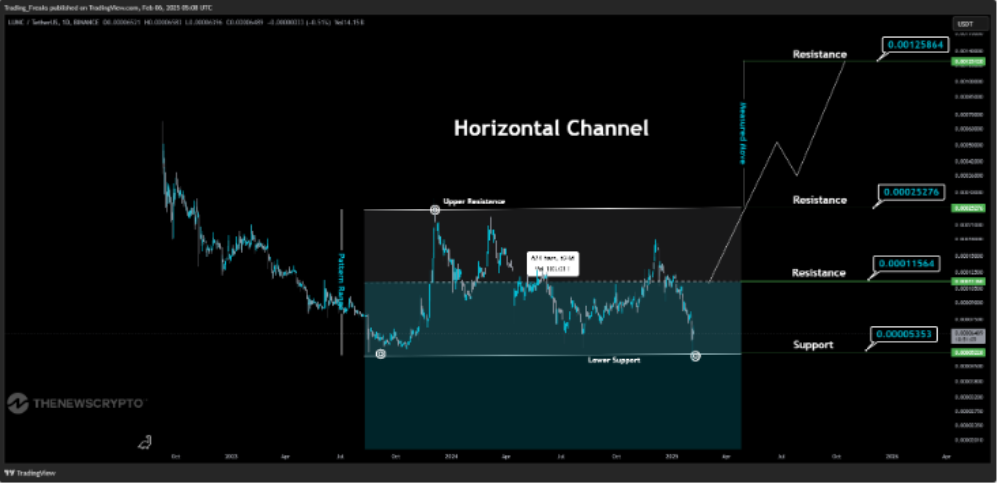

As of now, Terra Classic (LUNC) ranks 148th on CoinMarketCap, with its price fluctuating around $0.00006489. Despite the market’s volatility, LUNC has been following a horizontal channel pattern—a consolidation phase where the price moves between parallel support and resistance levels. If this trend continues, analysts predict LUNC could reach resistance levels of $0.00011564, $0.00025276, and even $0.00125864 in 2025. However, a trend reversal could pull the price down to support levels as low as $0.00005353.

Technical Indicators: What Do They Say?

To better understand the potential price movement of LUNC, let’s look at some key technical indicators:

- Relative Volume (RVOL) and Moving Averages (MA) show that LUNC is still in a consolidation phase, with low volatility.

- Relative Strength Index (RSI) indicates that LUNC is neither overbought nor oversold, meaning it could either see upward momentum or continue moving sideways.

- Average Directional Index (ADX) and Relative Volatility Index (RVI) suggest that LUNC’s price momentum is currently weak, though it could change with new developments in the Terra Classic ecosystem.

Price Prediction for 2025

Looking ahead to 2025, Terra Classic’s price prediction could swing both ways. The optimistic scenario sees LUNC reaching as high as $0.00037801, especially if the market sentiment turns bullish and investors’ confidence grows. However, a more cautious prediction places the price at around $0.00002372, particularly if the market remains bearish.

Long-Term Outlook (2026-2030)

While Terra Classic faces challenges in the short term, long-term predictions are more optimistic. If LUNC manages to secure more solid upgrades and expand its ecosystem, it could even surpass its previous all-time high of $119.18. Investors will need to monitor the crypto market and assess the impact of future advancements on LUNC’s price.

Conclusion

Terra Classic’s price journey has been tumultuous, but the road ahead offers potential for growth. Whether you’re an optimistic investor or a cautious one, it’s clear that LUNC has room to grow, provided the market sentiment and technological upgrades work in its favor. Keep an eye on the key resistance levels, and stay updated on any major shifts within the Terra Classic ecosystem to guide your investment strategy.