- The recent surge in price and market sentiment surrounding Terra LUNA Classic (LUNC), has attributed to strategic burn programs and positive market dynamics.

- Despite fluctuations and challenges, LUNC’s resurgence underscores its resilience in the cryptocurrency landscape.

Cryptocurrency enthusiasts have been closely monitoring the recent price surges and fluctuations of Terra LUNA Classic (LUNC). The digital asset, which experienced highs above $100 before a significant dip, has once again captured attention with its impressive price movements and strategic burn programs. Let’s delve into the dynamics driving LUNC’s resurgence and its implications for the market.

An Impressive Comeback Story

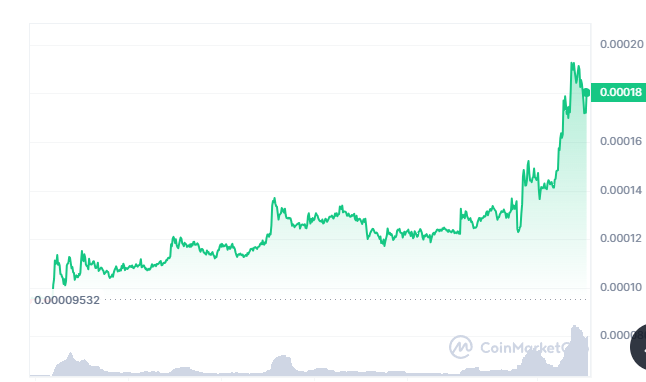

Following a turbulent period in 2022, during which LUNC reached highs above $100 before plummeting, the token has made a notable comeback. In just one week, it recorded a remarkable 14% increase, reaching $0.0001407. However, subsequent to this surge, there was an 8% drop from the peak, accompanied by a substantial 38% decrease in trading volume, which currently stands at $154,646,132. These fluctuations underscore the volatility inherent in the cryptocurrency market.

To address these challenges, Binance, a leading crypto exchange, initiated a burn program, removing a staggering $100 billion worth of LUNC tokens from circulation. This bold move, which accounted for over 51% of the total burning activity, played a pivotal role in driving the recent price surges. Today marks the 19th burn event for LUNC, expected to sustain the upward momentum and potentially stimulate further market movements.

A Closer Look at the Market

With a circulating supply of 5.7 trillion tokens and a total supply of 6.8 trillion tokens, the LUNC community is actively enhancing utility, securing finances, and increasing the burn rate. Despite the positive impact of the 18th burn on LUNC prices, market conditions remain a significant factor. Recent fluctuations in the broader crypto market, influenced by prominent coins like Bitcoin and Ethereum, have introduced an element of uncertainty.

Reflecting on Terra Classic’s performance, it achieved a record high of $119.01 on April 5, 2022, and an all-time low of $0.00001651 on May 13, 2022. Since then, the lowest recorded price has been $0.00001651, while the highest reached $0.000590. Presently, the prediction for Terra Classic’s price is bearish, with the Fear & Greed Index indicating extreme greed in the market.

Market Dynamics in Action

As Bitcoin approaches $64K, Terra Luna Classic (LUNC) and USTC values have surged. This trend followed the liquidation of LUNC, 1000LUNC, and USTC stakes, with LUNC witnessing a 10% rise in 24 hours and an impressive 45% increase over the month, reaching $0.000143. Meanwhile, USTC, despite a 1% dip in 24 hours, has maintained strength with a 42% month-long surge, trading at $0.0365, and experiencing a robust 58% increase in trading volume.

The recent price surges and market sentiment surrounding Terra LUNA Classic (LUNC) underscore the dynamic nature of the cryptocurrency landscape. While strategic initiatives such as burn programs can contribute to short-term price fluctuations, broader market dynamics and investor sentiment continue to play a significant role in shaping the trajectory of digital assets like LUNC.