- Tether has frozen $12.3 million in USDT on the Tron blockchain due to suspected illicit activity and AML concerns.

- The action supports ongoing efforts by Tether and its partners to combat crypto-related crime, including sanctions violations and money laundering.

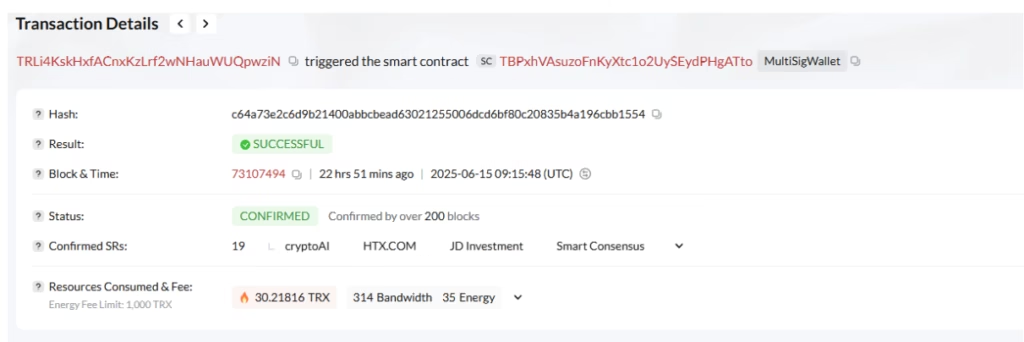

Tether, the issuer of the world’s largest stablecoin USDT, has frozen $12.3 million in funds on the Tron blockchain. The move signals a continued crackdown on illicit financial activity, including money laundering and sanctions violations. Though no formal statement has been issued, blockchain data confirms the freeze took place at 9:15 a.m. UTC on Sunday.

Tether Enforces Tight Controls to Combat Financial Crime

Tether’s freeze aligns with its strict wallet-blocking policy designed to prevent money laundering, terrorist financing, and the funding of nuclear proliferation. These efforts follow U.S. Treasury’s OFAC (Office of Foreign Assets Control) guidelines, particularly the Specially Designated Nationals (SDN) List. A previous Tether blog post dated March 7 affirmed the company’s alignment with OFAC’s sanctions enforcement.

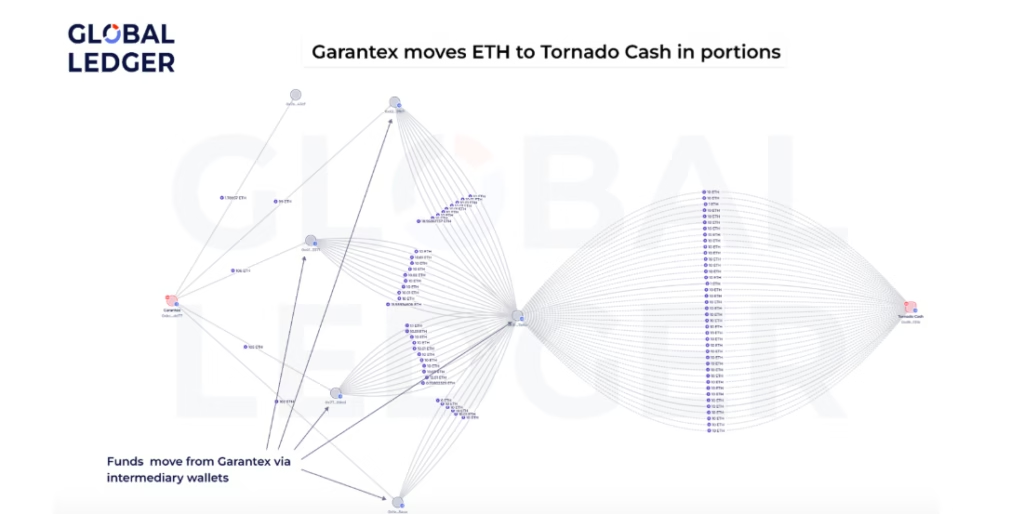

In recent months, Tether has demonstrated an aggressive approach to targeting illicit funds. On March 6, the company froze $27 million in USDT on the Garantex exchange, which is sanctioned by OFAC and alleged to have ignored AML requirements. Despite the freeze, over $15 million in active reserves connected to Garantex remained on-chain as of June 5.

Fighting Crime With Tech: The Role of the T3 Financial Crimes Unit

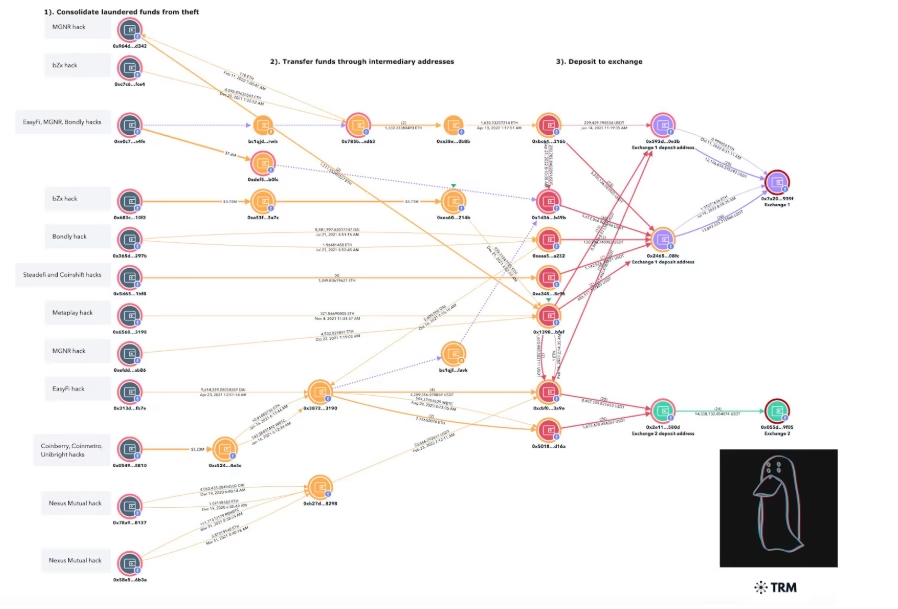

These enforcement actions are part of a broader campaign by the T3 Financial Crimes Unit (FCU), a joint effort between Tether, the Tron Network, and blockchain analytics firm TRM Labs. Launched in 2024, the FCU helped freeze $126 million in suspicious USDT transactions within its first six months.

The Lazarus Group—a North Korean state-backed hacker organization—has become a focal point of these crackdowns. Responsible for laundering over $200 million in crypto between 2020 and 2023, Lazarus has drawn significant scrutiny. In November 2023, Tether blacklisted $374,000 in stolen funds tied to the group. Other stablecoin issuers froze an additional $3.4 million linked to Lazarus wallets.

While some critics argue that freezing assets undermines decentralization, Tether’s decisive actions underscore the growing role of stablecoin issuers in preventing crypto-related crime.

ALSO READ:Vietnam Legally Defines Crypto Assets in New 2026 Law

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.