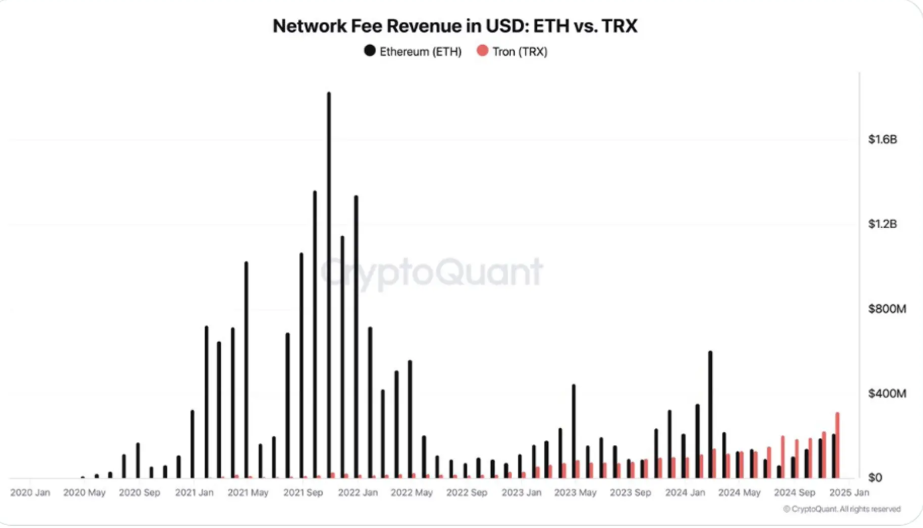

- TRON (TRX) has surpassed Ethereum (ETH) in network fee revenue, driven by its lower transaction costs and increasing adoption for stablecoin transfers.

- This shift highlights growing competition in the blockchain space, pushing Ethereum to enhance its scalability and cost-efficiency to maintain dominance.

The blockchain landscape is constantly evolving, and a recent development has turned heads in the crypto world. According to Ki Young Ju, CEO of CryptoQuant, TRON (TRX) has officially surpassed Ethereum (ETH) in network fee revenue. This unexpected shift raises important questions about the growing influence of TRON and the sustainability of Ethereum’s current model.

Breaking the Status Quo

For years, Ethereum has dominated the blockchain space, not only as the second-largest cryptocurrency by market capitalization but also as the go-to network for smart contracts and decentralized applications (dApps). Ethereum’s network fees, often criticized for being excessively high, have long been seen as a testament to the platform’s high demand and widespread usage. However, TRON’s recent leap ahead in fee revenue suggests that another player is emerging as a strong contender.

Why is TRON Surging?

Several factors contribute to TRON’s rise in network fee revenue. One of the most significant reasons is its growing adoption for stablecoin transactions, particularly USDT (Tether). TRON offers faster and cheaper transactions compared to Ethereum, making it a preferred choice for users who want to move funds efficiently.

Additionally, TRON has been actively expanding its ecosystem, fostering partnerships, and improving its blockchain infrastructure to accommodate high transaction volumes. The platform’s ability to offer lower fees and higher scalability makes it an attractive alternative to Ethereum, which continues to struggle with congestion and high gas fees.

What Does This Mean for Ethereum?

Ethereum has been working on addressing its network limitations, with upgrades such as Ethereum 2.0 and the transition to a proof-of-stake (PoS) mechanism. However, the growing competition from TRON highlights the urgent need for Ethereum to enhance its scalability and cost-efficiency.

While Ethereum remains a powerhouse in the DeFi and NFT spaces, TRON’s rising fee revenue signals that users are actively seeking alternatives. If Ethereum fails to lower transaction costs and improve speed, it could see more users migrating to networks like TRON.

Conclusion: A Shift in the Crypto Landscape?

TRON’s recent milestone is more than just a statistic—it’s a sign of shifting preferences in the crypto community. As blockchain technology advances, competition between networks will only intensify. Whether Ethereum can maintain its dominance or TRON will continue to gain ground remains to be seen. One thing is certain: the race for blockchain supremacy is far from over.