- TRON has cemented its dominance in stablecoin transactions with $11.4 billion in USDT transfers, driven by efficiency, low fees, and strong investor confidence, with 91% of TRX holders in profit.

- Speculation around TRON’s potential role in Trump’s crypto strategy adds to market intrigue, while technical indicators suggest possible price movements ahead.

TRON (TRX) is making headlines as it solidifies its position as the leading blockchain for stablecoin transactions. With a staggering $11.4 billion in USDT transfers, TRON’s dominance in crypto liquidity is undeniable. This development is reshaping market dynamics, attracting both institutional investors and retail traders alike.

TRON’s Stablecoin Supremacy

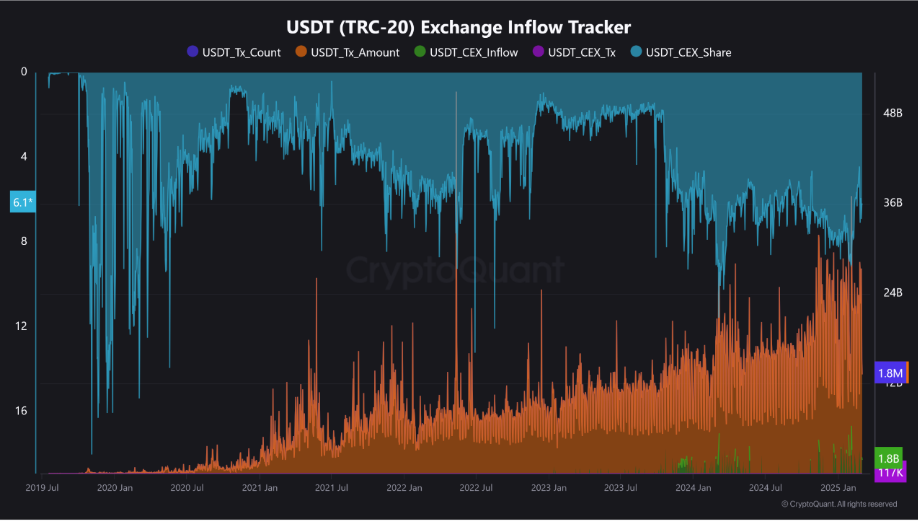

Recent data reveals that TRON has recorded 1.89 million USDT transactions, with $1.83 billion sent to major centralized exchanges (CEXs). Its ability to handle such a high transaction volume efficiently is attributed to its low fees and speed, making it the preferred network for stablecoin transfers.

The inflow of funds through exchanges, currently at 6.17%, highlights TRON’s critical role in maintaining market liquidity. This influx ensures smooth trading activities and minimizes volatility, reinforcing investor confidence in the network.

TRX Market Performance: Trends and Indicators

At the time of reporting, TRON’s (TRX) price stood at $0.2336, marking a 4.11% drop in the last 24 hours but reflecting a 1.46% gain over the past week. Market capitalization is at $20.12 billion, with a daily trading volume of $1.37 billion.

Technical indicators suggest potential market shifts. The Bollinger Bands are tightening, signaling an imminent change in volatility. If TRX surpasses its resistance level at $0.2369, it may rally toward $0.25. Conversely, failing to hold support at $0.2259 could result in a consolidation phase.

The Stochastic RSI at 58.30 suggests moderate bullish momentum, while the Aroon indicator shows a strong bullish signal at 71.43%, well above the downtrend threshold of 21.43%.

On-Chain Data: Strength in Holder Positioning

Investor sentiment surrounding TRX remains strong. A remarkable 91% of TRX holders are in profit, with only 5% at a loss. This indicates that most investors acquired TRX at lower price levels, reducing the likelihood of panic selling.

Moreover, large holders control 79% of TRX’s total supply. While this concentration can act as a stabilizing force, it also introduces risks—any sudden sell-off by major holders could trigger price volatility.

Whale and institutional activity is robust, with transactions over $100K amounting to $2.13 billion in the last seven days. Additionally, exchange net outflows of $68.72 million indicate that investors are moving TRX to private wallets, often a bullish sign for long-term holdings.

TRON and Trump’s Crypto Strategy: A Speculative Catalyst?

Market speculation is growing around TRON’s potential role in former U.S. President Donald Trump’s digital asset strategy. While TRON’s founder, Justin Sun, has hinted at TRX’s possible involvement, no official confirmation has been made.

Trump recently announced a list of cryptocurrencies for his strategic reserve, including Bitcoin, Ethereum, XRP, Solana, and Cardano. If TRON were to be included in such an initiative, it could drive significant institutional interest and elevate its market standing.

TRON’s latest surge in USDT transfers marks a defining moment in the crypto liquidity landscape. Its efficiency, strong investor positioning, and increasing institutional activity reinforce its dominance. With ongoing market speculation regarding its role in larger geopolitical crypto strategies, TRON remains a key player to watch in the evolving digital asset space.