- TRON investors realized 374% profits by selling long-held tokens as the network’s USDT supply surpassed $80 billion.

- Despite a drop in trading volume, TRX holds key support at $0.25, with 2025 price predictions ranging from $0.216 to $0.60.

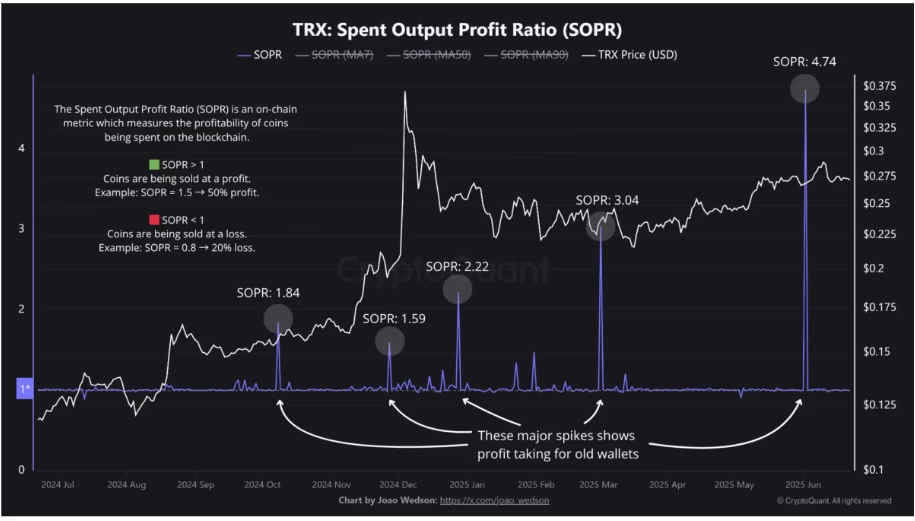

TRON (TRX) long-term holders realized average gains of 374% earlier this month. This profit-taking event, revealed through Spent Output Profit Ratio (SOPR) data, highlighted how TRX investors capitalized on tokens purchased near $0.0566—levels last seen in 2022—and sold around $0.268. The timing points to strategic decisions by early adopters, likely driven by either gain realization or portfolio rebalancing.

USDT Supply Soars, Reinforcing TRON Relevance

Despite the wave of selling, TRON’s ecosystem shows no signs of weakening. The network now hosts over $80 billion worth of USDT, cementing its place as the second-largest blockchain by stablecoin volume. TRON’s appeal lies in its low fees and rapid transactions, which continue to attract institutional and retail users for cross-border transfers and stablecoin trading.

The USDT supply on @trondao just surpassed 80 billion!

Tron is currently the second-largest network in USDT supply and the largest in daily USDT transactions pic.twitter.com/Y5amCSeow1

— Sentora (previously IntoTheBlock) (@SentoraHQ) June 23, 2025

Technical Support at $0.25 Could Spark a New Rally

Currently trading at $0.2739, TRX is slightly up by 0.48% on the day. However, trading volume has dropped sharply by 39.23%, signaling decreased short-term market activity. Technical analysis shows the coin dipping below its ascending channel and moving toward a crucial support level at $0.25, which aligns with the 200-day Simple Moving Average. Analysts suggest this zone could be a springboard for a 20% rally toward $0.30, with further upside potential to $0.45 if momentum builds.

🚨 $TRX Dipping Into Opportunity

TRX broke below Channel Up 📉

Now pulling back to $0.25 + 200 SMA — key support zone 🛡️

Strong bounce potential:

→ +20% to $0.30

→ +80% to $0.45 (long-term 🚀)

—

📊 Key Levels

▪️ Support: $0.25 → $0.22

▪️ Resistance: $0.30 → $0.45

📈 Trend:… pic.twitter.com/WZ7Qdu8Dq2— CoinCodeCap Trading (@c3_trading) June 24, 2025

2025 Price Forecasts: $0.216 or $0.60?

Looking ahead, 2025 forecasts for TRX vary dramatically. DigitalCoinPrice offers a bullish scenario with a $0.60 target, citing increased adoption and development. In contrast, Changelly presents a more cautious outlook, projecting a trading range between $0.216 and $0.256, with a mid-year average near $0.275. This wide forecast range reflects broader uncertainty about crypto market conditions next year.

While short-term price action remains flat, the combination of strong network fundamentals and strategic support levels positions TRON for a potentially bullish medium- to long-term trajectory.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.