- Uniswap is showing strong bullish signals after breaking key resistance levels, with analysts targeting prices above $14.

- Rising market cap, steady volume, and expanding volatility support the possibility of a continued rally.

Uniswap (UNI) is flashing strong bullish signals, with recent price action and technical data pointing to a potential rally that could push it past the $14 mark. Backed by a surge in market cap and solid buyer control, UNI appears poised for further gains in the short term.

Bullish Setup Confirmed as UNI Holds Above Key Levels

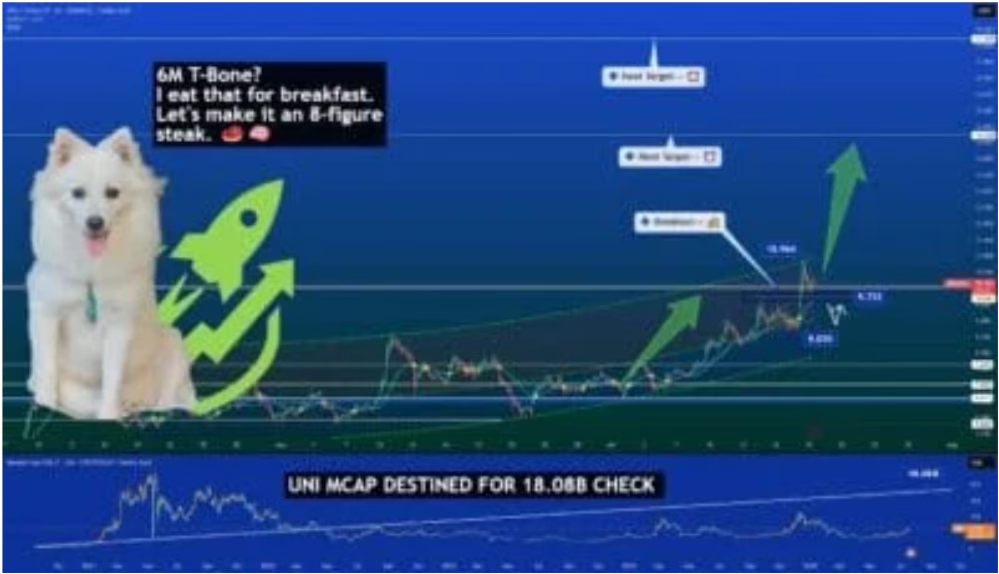

Uniswap has broken above the critical $9.732 resistance level, forming a foundation for continued upward movement. The price surged past $10.16, briefly tested $10.964, and now consolidates above $10.00—marking a bullish structure supported by rising volume and a confirmed Golden Cross. Analysts suggest that targets of $14.72 and even $17.70 are now in sight, provided this bullish channel holds.

Adding to this optimism, the Relative Strength Index (RSI) remains healthy, avoiding the overbought zone. Simultaneously, UNI’s market cap is climbing toward $18.08 billion, aligning with technical projections for price expansion.

Buyers Regain Control After Dip, Volume Supports Rally

In the past 24 hours, Uniswap recorded a 3.44% intraday gain, recovering from a session dip to close at $10.33. This comeback was marked by a series of higher lows, indicating strong buyer interest and a willingness to defend key support zones.

Daily trading volume came in at $490.69 million—moderate, yet sufficient to sustain recent gains. With over 600 million UNI tokens in circulation and a current market cap of $6.19 billion, Uniswap continues to showcase strong liquidity and resilience.

Bollinger Bands Signal Expanding Volatility

Technical indicators show that Uniswap is trading near the upper limit of its daily Bollinger Bands, hinting at rising volatility. The widening of the bands and positive BBPower readings underscore increasing buying pressure. If UNI holds above the baseline, the price could soon test the $11.50–$12.00 region.

Key support remains near $9.80, which aligns with recent consolidation zones. As long as volume remains steady and broader market sentiment does not turn risk-off, Uniswap’s rally appears well-supported.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.