- Uniswap (UNI) dropped below $9 following a broader market correction triggered by Bitcoin’s decline and leveraged selling.

- Despite short-term volatility, strong fundamentals like rising DEX volume, Uniswap v4 adoption, and whale accumulation suggest potential for a rebound toward the $13 target.

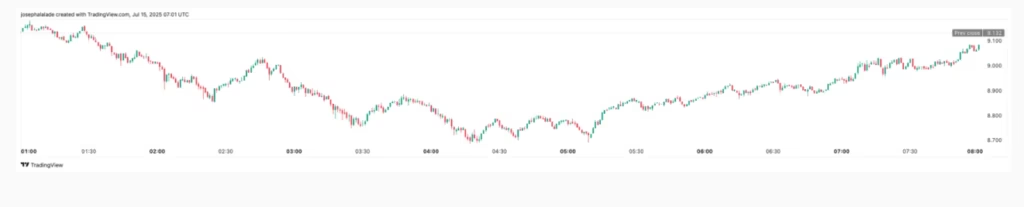

Uniswap’s native token, UNI, recently slipped by 3.82% in a 24-hour span, trading near $8.94 after a strong rally that pushed prices up nearly 20% the previous week. This decline reflects a short-term correction amid wider market movements, but many investors remain optimistic about UNI’s future potential.

Bitcoin’s Pullback Sparks Market-Wide Dip

The broader cryptocurrency market took a hit after Bitcoin dropped 3.56% from its peak above $123,000. This retreat caused around $165 million in Bitcoin liquidations and triggered a shift in capital from altcoins like UNI, XRP, ALGO, and SUI back into Bitcoin. The rise in Bitcoin’s market dominance to 63.48% pressured mid-cap DeFi tokens, including Uniswap, resulting in a sell-off amplified by leveraged traders rather than long-term holders. The spot versus perpetual futures ratio for UNI dropping to 0.46 confirms that much of the selling stemmed from short-term trading activity.

Strong Fundamentals Support Long-Term Growth

Despite recent price weakness, Uniswap’s core fundamentals remain robust. With over $5.28 billion in Total Value Locked (TVL), Uniswap remains a leading decentralized exchange (DEX). Recent monthly DEX trading volumes hit $73.55 billion, and Layer 2 (L2) scaling solutions continue to drive strong trading activity, surpassing $200 billion in volume this year.

L2 volume on the Uniswap Protocol this year has already crossed $200B

Pink acceleration 👀 pic.twitter.com/mYjInwTPXD

— Uniswap Labs 🦄 (@Uniswap) July 10, 2025

The rollout of Uniswap v4 highlights ongoing innovation, capturing more than 20% of daily trading volume and attracting over 400,000 liquidity providers and 2,200+ hooks—a testament to its growing ecosystem. Additionally, the native chain of Uniswap Labs, Unichain, has exceeded $1.05 billion in TVL, with Uniswap itself accounting for $581 million.

Key Resistance and Price Outlook

UNI’s price has been consolidating between $8.60 and $9.40, a critical range with historical resistance tied to its 2024 all-time high zone. A recent spike to $9.42 met immediate selling pressure, showing the challenge bulls face at this psychological barrier.

Notably, large wallets hold about 50.86% of UNI’s circulating supply, making the token sensitive to whale movements. A recent $25.5 million UNI withdrawal from Binance stirred speculation of potential repositioning rather than outright selling, which might limit exchange supply in the near term.

Analysts point to $9.00 as a crucial confirmation level. Should UNI maintain value above this range, the next major target is $13, which offers minimal resistance due to a “low-volume pocket.” This suggests that while short-term volatility persists, Uniswap’s long-term prospects remain intact, attracting bulls aiming for higher gains.

Uniswap’s recent dip mirrors wider crypto market corrections but does not overshadow its promising fundamentals and growth trajectory. For investors watching closely, the $9.00 mark is key to watch, potentially paving the way for UNI to reclaim stronger upward momentum toward $13.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.