- Uniswap staking in 2025 works through liquidity provision, where users deposit token pairs in pools to earn trading fees.

- While rewards can be high, risks like impermanent loss, high gas fees, and smart contract vulnerabilities remain.

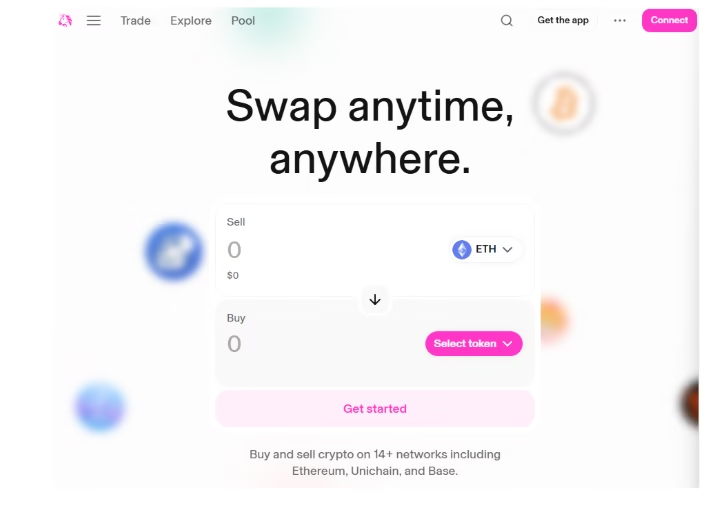

Uniswap remains one of the largest decentralized exchanges in the crypto space, but staking UNI isn’t as straightforward as with other platforms. Instead of traditional staking, users provide liquidity to pools and earn a share of transaction fees. In 2025, Uniswap continues to evolve with Layer-2 integrations and its much-anticipated V4 upgrade, creating fresh opportunities and risks for liquidity providers.

ALSO READ:Can Uniswap Price Break $11 Resistance After Signs of Accumulation?

How Staking on Uniswap Works

Unlike centralized exchanges, Uniswap doesn’t match buyers and sellers directly. Instead, it uses liquidity pools—smart contracts containing token pairs that facilitate instant trades. Liquidity providers (LPs) deposit tokens into these pools and earn a portion of the 0.3% trading fee. The share of fees depends on how much liquidity they contribute relative to the pool size.

For example, the ETH/ONDO pool currently offers the highest return, with APRs reaching 80.803%. However, APRs vary widely depending on the token pair and market activity.

The Risks of Uniswap’s Staking

While liquidity provision can be lucrative, it also comes with significant risks:

- Impermanent Loss: If token prices move drastically after you deposit, your final withdrawal value may drop.

- Smart Contract Vulnerabilities: Though Uniswap is well-audited, bugs remain a risk.

- Hacks and Phishing: As with any DeFi platform, attackers target liquidity providers.

- Regulatory Uncertainty: Evolving rules could impact user access in certain regions.

These risks make it essential to carefully research pools before committing capital.

How Uniswap Compares to PancakeSwap

When compared with PancakeSwap, Uniswap usually offers lower staking returns due to higher gas fees and impermanent loss exposure. For example, the CAKE/USDT pool yields around 35.213% on Uniswap but 47.48% on PancakeSwap. That said, Uniswap has deeper liquidity for major ERC-20 tokens and remains the go-to platform for Ethereum-based assets.

New UNI Staking Opportunities in 2025

Uniswap is introducing fresh ways to stake UNI itself:

- Unichain Rollup Staking: UNI holders can now stake tokens directly on Uniswap’s Layer-2 rollup to secure validators and earn revenue-sharing rewards.

- Incentive Programs: UNI V3 LP NFTs can be staked in liquidity mining campaigns to earn additional tokens like ARB or OP.

- External Lending: Platforms such as Aave and Compound allow UNI holders to earn interest without providing liquidity.

These options give investors more flexibility beyond traditional liquidity pools.

Conclusion: Is Uniswap Staking Worth It?

Uniswap’s staking in 2025 is best suited for experienced DeFi users who understand liquidity provision and its risks. With APRs like 80.803% on ETH/ONDO, the rewards can be attractive, but impermanent loss, smart contract risks, and high gas fees may limit profits. For beginners, alternatives like Best Wallet offer simpler staking options across multiple blockchains.

Uniswap remains a leader in decentralized trading and continues to expand with L2 solutions, making it a compelling platform for those willing to navigate its complexities.

MIGHT ALSO LIKE:IOTA TVL Surges to $36M as Token Eyes $0.50 Breakout.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.