For background reading, see our earlier coverage: Uniswap v4 Innovative Features and Uniswap v4 Speculation for 2025. This guide focuses on the concrete differences between Uniswap v4 vs v3—and what they mean for traders, liquidity providers, and developers.

Quick Jump

- v4 vs v3 — Snapshot Table

- 1. Architecture & Gas Efficiency

- 2. Fee & Liquidity Accounting

- 3. Native ETH & Cost Savings

- 4. Hooks, Subscribers & Developer Power

- 5. Bridging & Cross-Chain Outlook

- 6. Impact on Traders, LPs & Builders

- 7. How to Prepare for Uniswap v4

- FAQ

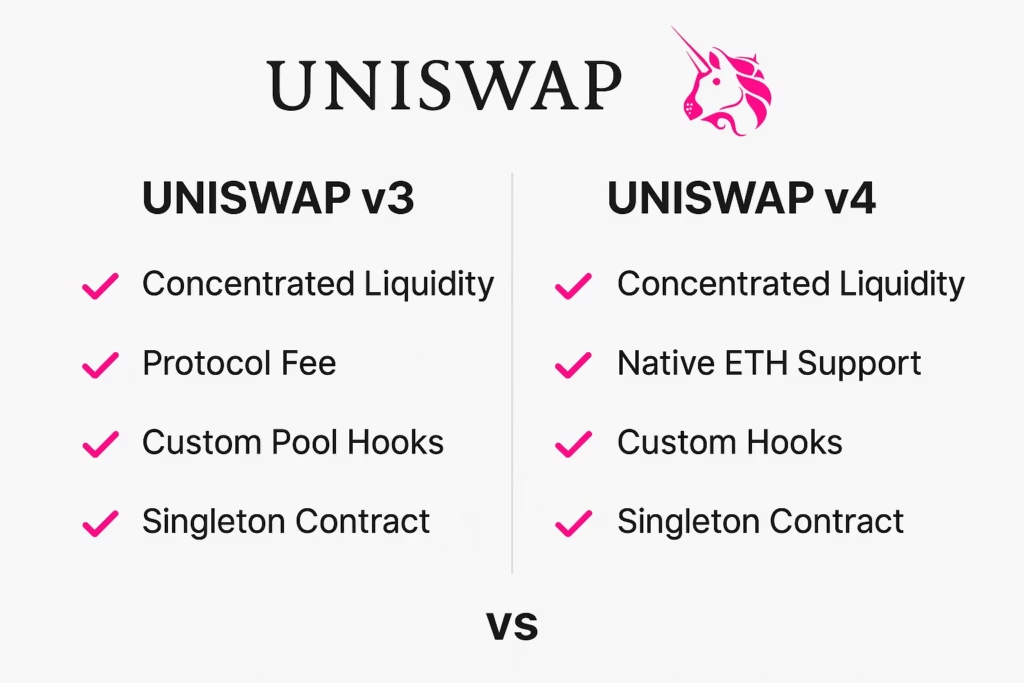

Since launching concentrated liquidity in 2021, Uniswap v3 has dominated DEX volume. The Uniswap v4 is an upgrade to v3 that builds on that engine but rewrites the plumbing to cut gas, simplify pool creation, and unlock composable “hooks.” Below, we explore each change, potential cross-chain roadmaps, and practical steps to prepare.

Uniswap v4 vs v3 — Snapshot Table

| Feature | Uniswap v3 (2021) | Uniswap v4 (2025) |

|---|---|---|

| Contract Design | Factory deploys a new pool contract for every pair | Singleton contract stores all pools—one deployment, shared code |

| Accounting Model | Transfers after each call | Flash accounting: settle net balances once, lowering gas |

| Fee Handling | Shared state; manual fee management by integrator | Fees roll into liquidity on add; optional salt for separate positions |

| ETH Support | Must wrap to WETH | Accepts native ETH (no wrapping cost) |

| Extensibility | Fixed logic (fee-tier choice only) | Hooks & Subscribers enable custom code & reward tracking |

1. Architecture & Gas Efficiency

The signature shift in v4 is the singleton contract. Instead of spinning up thousands of pool contracts, v4 keeps pool state in storage slots of a single contract. The result:

- Pool creation gas drops by more than 99 % versus v3’s contract deployment.

- Multi-hop swaps skip external calls, saving ~30–35 % gas on average routes.

- Audit surface narrows—auditors review one codebase, not countless clones.

2. Fee & Liquidity Accounting

Uniswap v4 introduces flash accounting: a transaction can bundle many swaps and liquidity edits while token balances update only at the end. For arbitrageurs and routing contracts, that means:

- Fewer ERC-20 transfers → lower gas.

- Less MEV risk from partial state updates.

The liquidity math is also smarter. Accrued fees behave like store credit: if you increase liquidity, fees roll into the new position; if you decrease, unclaimed fees pay out automatically. LPs can further separate identical ranges with a salt identifier, simplifying bookkeeping for vaults.

3. Native ETH & Cost Savings

Wrapping ETH to WETH costs roughly 15,000 gas plus an approval transaction. v4 removes both steps by letting pools pair directly with native ETH. Besides lower costs, it streamlines onboarding for retail users who never understand “wrap.”

4. Hooks, Subscribers & Developer Power

Hooks are opt-in smart-contract callbacks fired at key lifecycle moments (e.g., beforeSwap, afterAddLiquidity). Some early ideas:

- Dynamic fee curves that rise during volatility

- Oracle updates and TWAP limit orders

- Gas-rebate hooks for high-frequency LP strategies

Subscribers give LP NFTs a push-notification layer: staking or incentive contracts can listen for liquidity changes without taking custody of the NFT—reducing user risk.

5. Bridging & Cross-Chain Outlook

Although not included in the initial codebase, Uniswap governance forums have floated designs for a cross-chain liquidity mesh using messaging protocols like CCIP or LayerZero. If adopted, the singleton could coordinate mirrored pools across major roll-ups, pooling depth and routing orders to the best venue.

Status: purely speculative until a Uniswap Improvement Proposal (UIP) is submitted and audited.

6. Impact on Traders, LPs & Builders

- Traders get cheaper routes, especially on multi-hop cross-asset deals.

- Liquidity providers earn fees more efficiently and can automate strategies through vault hooks.

- DeFi builders gain a plug-in marketplace for custom pool behaviour—no need to fork the core AMM.

- Governance & tokenholders may steer future fee-sharing models, potentially adding new UNI staking yields.

7. How to Prepare for Uniswap v4

- Follow the devnet: Watch GitHub commits and audit reports.

- Test strategies: When a public testnet drops, benchmark gas for your existing v3 positions.

- Evaluate tooling: Check if your analytics dashboards, bots, or custody solutions support v4’s singleton architecture.

- Monitor governance: UNI holders can influence fee-switch decisions that affect long-term revenue.

Uniswap v4 refines the AMM blueprint rather than reinventing it. By shrinking contract bloat, embracing native ETH, and introducing programmable hooks, the upgrade lays a flexible foundation for the next wave of DeFi apps. Whether bridging across chains or powering new yield vaults, the singleton approach positions Uniswap to remain the liquidity hub of Ethereum’s expanding ecosystem.

FAQ on Uniswap v4 vs v3

When will Uniswap v4 go live on mainnet?

The core team has not set a firm date. After audits conclude, governance must vote to deploy the singleton. Most community estimates point to late 2025, but timelines can shift.

Will my v3 LP NFTs automatically migrate?

No. v3 and v4 use different contract architectures. You will need to withdraw liquidity from v3 and deposit it into v4 pools once they exist.

Do hooks add security risks?

Hooks are opt-in and must be audited separately. Because they run within the singleton context, a buggy hook could potentially brick a pool, so careful governance and audits are essential.

How much gas can I save with native ETH?

Removing the wrap/unwrap cycle saves roughly 15 000 gas per swap and eliminates an additional approval transaction—translating to 5–10 USD at typical L1 gas prices.

Will Uniswap v4 support layer-2 networks on day one?

The launch plan prioritises Ethereum mainnet. Layer-2 deployments will follow once the core contracts stabilise and governance approves specific roll-ups.

Uniswap v4 refines the AMM blueprint rather than reinventing it. By shrinking contract bloat, embracing native ETH, and introducing programmable hooks, the upgrade lays a flexible foundation for the next wave of DeFi apps. Whether bridging across chains or powering new yield vaults, the singleton approach positions Uniswap to remain the liquidity hub of Ethereum’s expanding ecosystem. check the comparison from Uniswap Official blog page here